In our fast-paced business world, financial clarity is the key to managing a successful enterprise. And the key to financial clarity lying at the heart of all standardised accounting guidelines is the “matching principle,” which states that expenses associated with specific revenue should be recognised during the same period in which that revenue is earned. Determining when a business has earned revenue, then, becomes the crucial first step in accrual-basis accounting, the accounting approach required by U.S. Generally Accepted Accounting Principles (GAAP) and International Financial Reporting Standards (IFRS). In short, revenue recognition is the “dropped pin” around which the rest of accounting and financial reporting revolves.

The snag is: This isn’t as simple as it sounds for professional services firms, such as attorneys, auditors and consultants. In this article, we explore the challenges and solutions professional services firms encounter when tackling the intricacies of revenue recognition.

What Is Revenue Recognition for Professional Services?

Just because a professional services firm has received cash does not mean the business has “earned” it — at least, not under the accrual-basis accounting method, which is the only standards-compliant accounting approach. Revenue recognition centers on the set of accounting guidelines that helps a business’s accountants know when and how to reflect sales as revenue. For example, a service provider may win a deal and be paid some or all of its fee before a project begins, but that payment cannot be considered revenue until it is earned through the provision of services.

By understanding the nuanced guidelines for revenue recognition, accountants can create detailed financial reports that more accurately reflect a professional service organisation’s business health, because revenue and the expenses required to produce that revenue are matched together in the same reporting period. This gives firm leaders better information about the business’s financial performance, which they can use to make decisions that build long-term growth. Proper revenue recognition also helps make sure the organisation complies with regulatory guidelines, reducing the risk of legal, financial or reputational harm caused by noncompliance.

Very small businesses that don’t need to comply with GAAP or IFRS, on the other hand, may sidestep the revenue recognition issue altogether by operating under cash-basis accounting. In the cash-basis approach, revenue is earned and expenses incurred whenever payments are transacted — in other words, when money changes hands.

Key Takeaways

- Revenue recognition standards determine how and when professional services firms can consider revenue “earned” and recognise it in their financial records.

- Regardless of when money changes hands, accounting guidance is to recognise revenue when the corresponding service is performed and the revenue is, therefore, earned. But that often requires judgement calls for professional services firms’ accountants.

- Revenue recognition standards help firms better track their overall financial health and provide business leaders with more effective information for decision-making.

- Large and/or public services firms must follow GAAP/IFRS revenue recognition standards.

Revenue Recognition for Professional Services Explained

Revenue recognition is important for all businesses but professional services firms face unique challenges when recognising revenue. These challenges stem from the complex contracts, multiple performance obligations and variable pricing structures that are often used by services-based businesses, such as IT or management consulting firms, accountants and marketing agencies. These businesses’ revenue recognition rules must do more than comply with accounting standards; they strive to accurately show the financial health and performance of the business and reflect the pace and depth of how customers receive services. With proper revenue recognition, these companies can better predict profitability, make informed strategic decisions and provide transparent reporting to stakeholders.

For example, say an IT consulting firm embarks on overhauling a client’s digital infrastructure, with plans to incrementally implement changes over the coming year. If the firm receives an up-front payment of $1 million at the start of the project, it has cash in hand — but the revenue has not yet been earned and should not be recognised in the company’s income statement. Instead, the business’s accountants, guided by revenue recognition accounting standards, will recognise the revenue across the duration of the project. So, if the firm completes 25% of the project in the first quarter, it will recognise $250,000, or 25% of the payment, as revenue for that quarter. The balance of the payment, $750,000, would be held in a deferred revenue account (a liability account, because it represents the consulting firm’s future obligation). Compared with a cash-basis business that would recognise the whole $1 million on the day it was received, the matching approach embedded in revenue recognition guidelines gives a more accurate picture of the firm’s earnings and financial stability over time and better aligns with the services it is providing.

Basics of Revenue Recognition

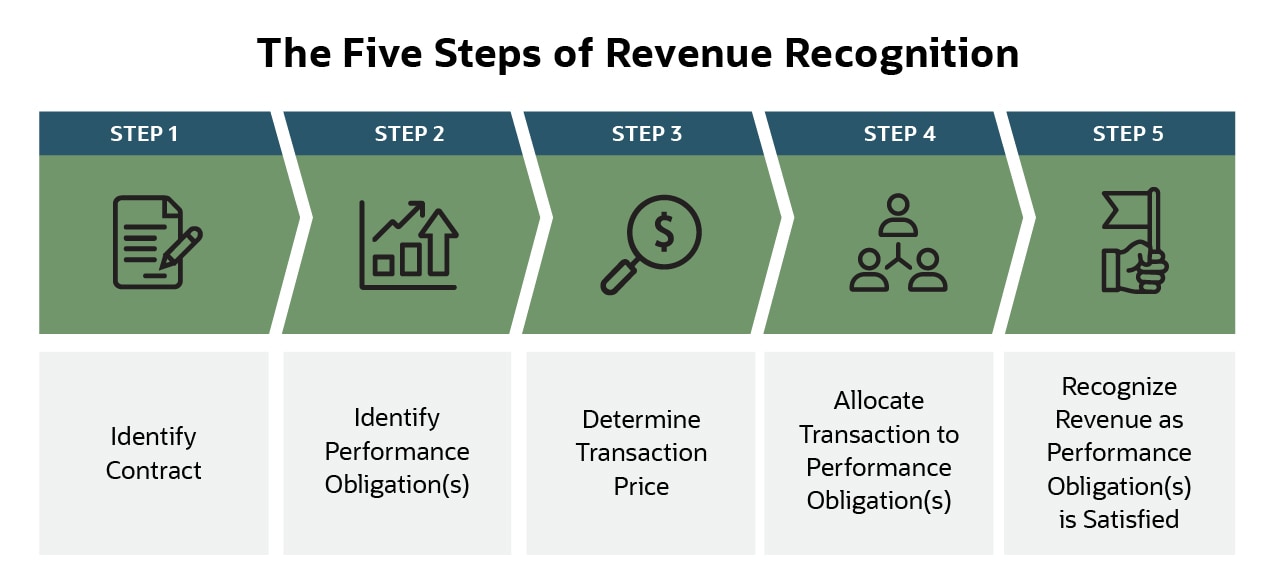

Though many accounting principles differ between the U.S. and other countries, revenue recognition is unified. In 2014, the US.-based Financial Accounting Standards Board and the International Accounting Standards Board jointly issued revenue recognition guidance to converge GAAP standards and the IFRS’s international standards into one cohesive set of guidelines for recognising revenue, known as Accounting Standards Codification (ASC) 606. This established a basic five-step framework to minimise confusion, enhance comparisons and simplify revenue recognition across industries.

The five steps of ASC 606 are explored in detail below, illustrated by the fictional scenario of a marketing agency, JTK Enterprises, contracted to deliver monthly ads to a customer for one year. It’s important to note that even though the five steps are viewed as a linear progression, in practice, a professional services firm would perform the first three steps simultaneously, or nearly so. The final two steps represent output from the first three that informs business accountants’ actions concerning revenue recognition.

-

Identifying the Contract With a Customer

ASC 606 assumes that contracts for professional services are clearly defined and that they lay out the nature and timing of services. By accurately identifying contract terms early, accountants can plan ahead for when and how the business will recognise revenue, setting the stage for the timing of subsequent steps in the revenue recognition process. Professional services contracts typically include payment terms, obligations and rights for all parties. During the negotiation stage, both parties must also establish that the agreed-upon payment is in line with the commercial value of the service and that it is “probable” — an accounting term that simply means that the customer can afford the price. JTK’s advertising contract includes a schedule of 12 monthly payments and outlines the tasks the agency and the customer will be responsible for during the contract’s term, such as creating ads, scheduling them and buying the advertising. Both the customer and JTK must approve and sign the contract before work can begin.

-

Identifying the Performance Obligations

For this step, the service provider must identify the promises it made in the contract to determine the specific goods or services it will provide, which ASC 606 calls “performance obligations.” These obligations may include a one-time delivery of goods or services or a series of ongoing deliverables. This step outlines when contractual obligations will be met and when some, or all, of the associated revenue can be recognised. For example, JTK is responsible for creating and delivering one ad at the start of every month for the entire year to satisfy its performance obligations. It is not responsible for the cost of ad placement, which the customer will pay directly to the media firms that run the ad. If JTK fails to deliver the ads as scheduled, the agency cannot recognise revenue until the service is performed, potentially reducing current revenue and delaying future revenue as the contract continues.

-

Determining the Transaction Price

Understanding its performance obligations allows the service provider to determine the value and overall price of the service(s) under the contract — a critical step for budgeting the project and planning for the flow of anticipated revenue. For professional services firms, there are several variables to consider when setting prices, including allocating resource costs and anticipating uncertainties when determining the project length. Once all fixed and variable costs have been estimated, the final price can be set and approved by all parties. The final transaction price may also be adjusted for “considerations payable to the customer” — another accounting term, this one for noting any additional discounts, noncash factors or other price offsets.

Let’s say JTK calculates its labor and resource costs, plus profit, and proposes a project fee for the 12 months of $126,000, or monthly payments of $10,500. But the agency offers a $12,000 discount to customers that pay the entire amount up front, as the project begins. Additionally, JTK agrees to use the customer’s digital infrastructure to test ads, which would otherwise have cost JTK $6,000 over the course of the year. After these adjustments are made, the total transaction price is either $108,000 up front ($126,000 – [$12,000 discount + $6,000 adjustment]) or $10,000 per month ([$126,000 – $6,000] / 12 months). This pricing transparency helps customers and businesses understand the value and price of the service and puts hard numbers and timelines on payments. In this case, JTK’s customer chooses the $10,000 monthly payments.

-

Allocating the Transaction Price

Using the output from step 3, accountants allocate expected revenue to a contract’s performance obligations. To do so, they calculate standalone selling prices for each part of the service and assign the appropriate share of revenue to each obligation. This process ensures that revenue recognition accurately reflects the value and pace of the services as they’re delivered over time. ASC 606 expects that estimated allocations are based on realistic, good-faith estimations of real costs, as accurate allocation promotes transparency for financial reporting and allows customers to see where their money is going. Returning to JTK, it allocates the $10,000 monthly revenue per ad as follows: $7,000 for the initial creation of the ad, $2,000 for edits and modifications based on customer feedback and $1,000 for a follow-up performance report at the end of the month. While JTK and its customer have already agreed to a single monthly payment, ASC 606 allows these services to be billed as separate transactions throughout the project or itemised in the contract and billed all at once.

-

Recognising Revenue When/As the Performance Obligation Is Satisfied

As companies perform their services and meet their obligations, they can recognise revenue and record it on their income statement (aka P&L, or profit and loss statement). If a customer has already paid, those monies would be included in the cash asset account on the firm’s balance sheet and offset by an equal amount in the deferred revenue liability account. For JTK, once the initial ad is delivered, it recognises $7,000 in revenue. Then, after client feedback and edits, another $2,000 is tallied. And finally, once it gives the performance report to the customer, the final $1,000 is recognised. No revenue can be recognised until these benchmarks are reached, regardless of when the customer paid. This timing will be reported on the company’s financial statements, painting a detailed picture of business performance for decision-makers.

Following these five ASC 606 steps is required of any professional services firm that complies with either GAAP or IFRS. That is likely to include all but the smallest businesses, the latter of which may opt to operate on cash-basis accounting, instead of accrual-basis.

Challenges in Revenue Recognition for Professional Services

Even businesses closely following GAAP/IFRS guidelines often face challenges when planning and implementing revenue recognition procedures. To overcome these challenges, financial professionals must consider the unique complexities of their firm’s services and develop strategies that fit their business model and customers’ needs. Here are four of the most common revenue recognition challenges and how professional services companies can overcome them.

Variability in Consideration

Variability can arise in many aspects of services contracts, including completion deadlines and performance benchmarks. For example, the total price changes if a firm delivers a job ahead of schedule on a contract that stipulates extra consideration for early completion. Or, likewise on the flip side — if the firm delivers late and the contract stipulates a penalty. When determining transaction prices, the customer and the provider must be clear on where the likelihood of major variability can be estimated, in good faith, and how it will impact the service and its associated revenue. This transparency helps both parties remain informed and satisfied, even in the face of complications or deviations from the original service agreement.

Multiple Performance Obligations

Businesses performing services specifying two or more obligations must meet the required criteria for each one before associated revenue can be recognised. This often adds accounting complexity, as there will be multiple points where a fraction of total revenue will be recognised throughout the project’s life. To effectively manage multiple obligations, accountants must set standalone selling prices for each obligation and track progress toward each. This compartmentalisation ensures that the appropriate revenue is recognised accurately and at the proper time. Businesses with overlapping or closely intertwined obligations, however, must be careful to clearly define where one step ends and the other begins, or they run the risk of inaccurate financial statements and confused customers.

Contract Modifications

Contracts create an important framework for professional services, but they can be modified throughout a project. Modifications most often occur if the nature of the service changes or requires more purchases or service hours than originally envisioned. Such changes require approval from all parties and can add another layer of complexity to revenue recognition. Businesses can recalibrate revenue from modifications in different ways, with some cases treated as a separate add-on contract that supplements, rather than replaces, the original revenue recognition timeline. A law firm, for example, may discover a new complication during an engagement that requires special expertise and, therefore, a separate, additional engagement. For other situations, small modifications can cause slight adjustments, while major shifts may cause the parties to terminate the existing contract and replace it with new terms, starting the revenue recognition process over from step one. Alternatively, a company may use catch-up financial adjustments to match the cumulative revenue recognised and realign the contract with up-to-date figures. Whatever method a business uses, financial professionals must carefully evaluate the modifications to ensure accurate revenue recognition and transparency with customers.

Time-Based Considerations

Under GAAP guidelines, revenue is recognised when performance obligations in the contract are satisfied. But that timing may not be clear, especially for ongoing services. Companies typically have two options for choosing when to recognise revenue: when specific benchmarks are reached or at regular intervals throughout an ongoing project. Companies offering multiple types of services may need to employ both methods, depending on the service, and will need to carefully plan when and how revenue will be recognised. Otherwise, revenue may not be correctly recorded, leading to less accurate project estimates in the future, as well as flawed financial records.

Methods of Revenue Recognition for Professional Services

Choosing the right revenue recognition method hinges on the type of service, the contract terms and the reliability and availability of performance metrics. For example, an ongoing consulting service might recognise revenue incrementally as time goes on, perhaps monthly, whereas a construction company may recognise the entire revenue at the end of the service or as specific project milestones are completed. Companies must understand when and how to use different revenue recognition methods to ensure accurate financial reporting. These methods are discussed in more detail below.

Point-in-Time Recognition

The point-in-time revenue recognition method is typically used when a specific and limited service is provided, such as a single training session, or when a product is delivered to a customer. This method provides a clear and straightforward way to recognise revenue. However, the point-in-time method may not be appropriate for all services, particularly those that involve ongoing or complex contracts, which may require more detailed benchmarks.

Over-Time Recognition

Revenue can also be recognised over time, primarily for ongoing services or projects with multiple phases and/or deliverables. Over-time recognition includes two primary approaches, one based on inputs and the other on outputs.

- Input methods recognise revenue based on the service provider’s efforts and costs incurred to satisfy the performance obligation(s), typically including labor hours and expenses. Input methods are most appropriate when the effort expended directly correlates with the value provided. A law firm, for example, might recognise revenue based on the number of case hours worked throughout the contracted period.

- Output methods recognise revenue based on the timing and value of the service performed. They’re often used for services where the value is more closely tied to the results achieved, such as a corporate cleaning company that recognises revenue based on the percentage of buildings cleaned as the project continues.

Revenue Recognition Best Practices for Professional Services

To keep up with the evolving complexities of revenue recognition, professional service providers should regularly assess how they recognise revenue to ensure effective financial reporting and remain compliant with current regulatory standards. Revenue recognition best practices can even help companies improve the accuracy of future contracts and estimates. By implementing up-to-date best practices, businesses can increase financial visibility, make well-informed decisions and provide more transparent reporting to analysts and stakeholders. Here are some key best practices to help businesses effectively track and record revenue.

Understand the Standards

The reason accounting has principles and guidelines instead of hard-and-fast rules is that many, if not most, accounting decisions call for some degree of judgment. Accountants and other finance professionals must have a very deep understanding of the joint GAAP/IFRS framework codified in ASC 606 in order to render solid revenue recognition judgments. Companies often consult internal accounting experts or external financial professionals when implementing new revenue recognition standards to make sure guidelines are being followed properly and revenue is being correctly recognised.

Use Time-Based Recognition Properly

Time-based recognition allows companies to realise revenue as the business fulfills performance obligations, rather than when customers pay. But different businesses have different needs when it comes to revenue recognition. To be sure that their accounting methods are deliberate and informed by their overall business strategy, businesses should align their revenue recognition practices with the nature of their delivered services. For example, a software-as-a-service (SaaS) company with monthly subscriptions will likely time its revenue recognition differently from a consultancy that bills hourly. The SaaS provider would likely recognise revenue monthly, regardless of whether a given customer paid for an entire year up front. The consultant would likely align revenue recognition to meeting specific milestones during the course of a client engagement. By considering and implementing appropriate time-based recognition policies, companies can develop revenue recognition approaches that accurately reflect their business, enhancing financial clarity.

Regularly Review Contract Progress and Adjust Estimates

As a project progresses, analysts and relevant staff should regularly review it in a two-step process, adjusting estimates as budgets and forecasts meet reality. The first step is to regularly assess progress with the customer to make sure the contract is being fulfilled properly, on time, etc. Then, information from the review should be used by accountants to make adjustments as needed. These adjustments may derive from underestimates, such as those made before a spike in input costs, or overestimates, such as a project that finishes ahead of schedule. Ongoing reviews ensure that revenue aligns with the actual progress and value of the services provided by reassessing the transaction price, adjusting timelines or recalibrating realistic performance obligations. These adjustments also help apprise customers of any changes and allow both the business and the customer to shift expectations.

Furthermore, this practice can be used to improve future contract estimates. By tracking revenue and expenses for specific deliverables and benchmarks, firms can more clearly see where their original revenue and expense projections were off base. So, if a firm learns that a project was underestimated by 10% because of materials costs, it can increase its estimates on the next similar project, leading to a more accurate estimate of costs and revenue. Or, if the 10% increase was from overtime pay during the final phase, a future contract could include a longer timeline to reduce the likelihood of falling behind schedule. The more granularly detailed a firm’s revenue recognition process is, the more information it generates to improve future project estimates. Revenue recognised as one lump sum at the end of a project is far less informative.

Use Advanced Accounting Software

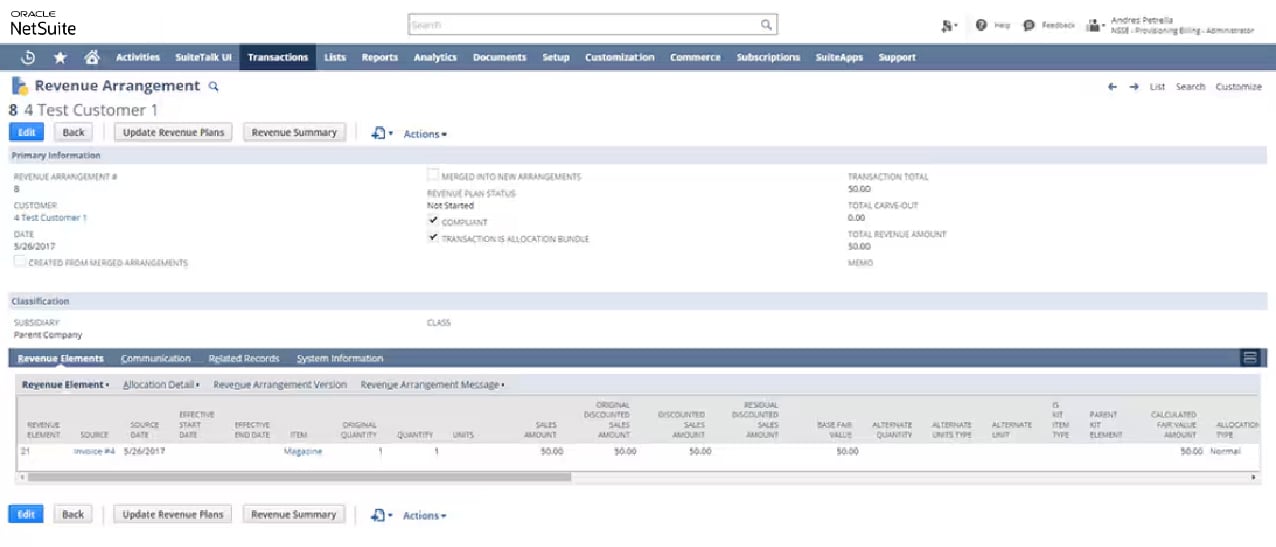

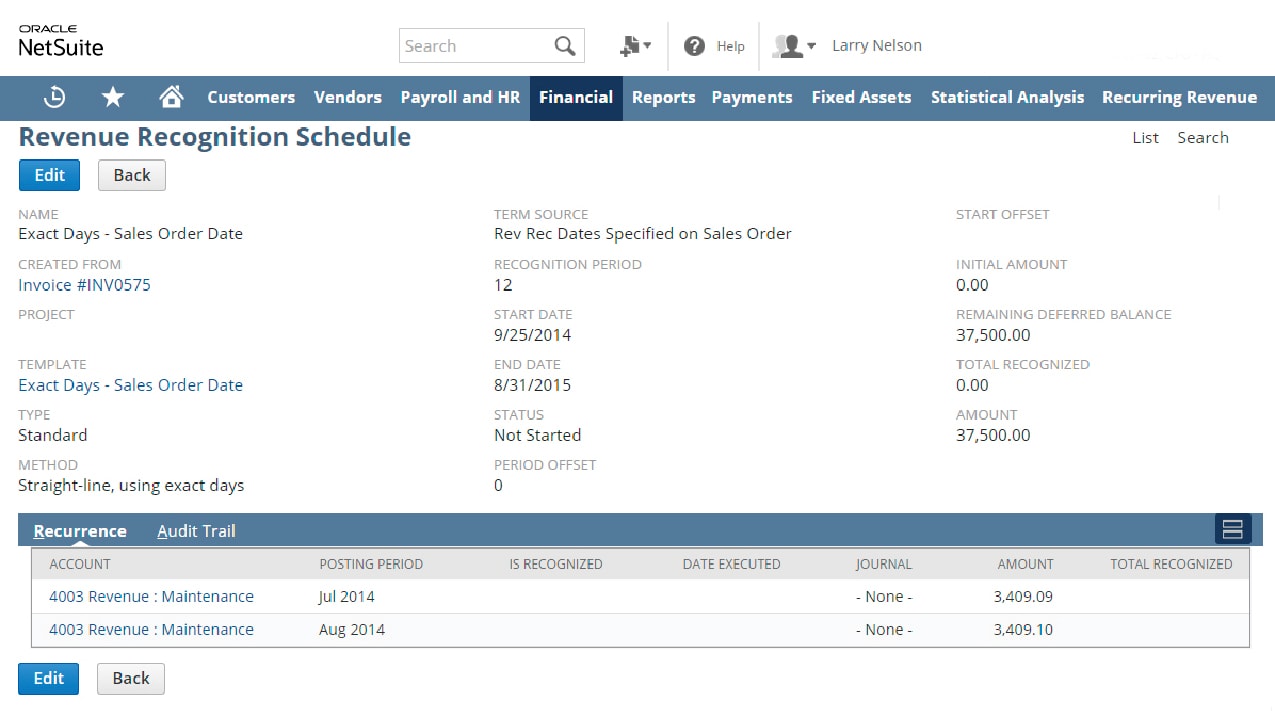

As organisations grow and take on more and larger projects, each with their own obligations and financial timelines, revenue recognition grows too complex to reliably manage through manual processes. By leveraging advanced accounting software, companies can automate revenue recognition based on customisable timetables or when milestones are reached, ensuring accuracy, efficiency and compliance with internal and regulatory standards. Additionally, many accounting software platforms can be integrated into a larger enterprise resource planning (ERP) system. By streamlining operations with a centralised system, business leaders can gain a comprehensive and holistic view of operations, including up-to-date revenue information.

Revenue Recognition with Accounting Software

Train Your Teams

Businesses need more than a well-defined revenue recognition process. Project team members must understand how and when revenue will be recognised for each project they work on. Project managers and business leaders can prioritise revenue recognition training for staff at all levels, including accountants, analysts, salespeople and contract writers. This training helps team members understand the nuances of their specific industry and the common challenges they may face. And, regularly updating this training means staff can adjust to any changes in accounting standards or business practices, thus proactively reducing errors and potential compliance issues.

Maintain Transparent Communication With Stakeholders

Stakeholders need an accurate and realistic view of the company’s financial health to make effective decisions. Clear, consistent communication about the business’s revenue recognition practices can help build that understanding for stakeholders. Such communication should include a transparent view of revenue recognition procedures, along with any factors or fluctuations that can affect these processes, such as variable costs or uncertainties. Regularly updating relevant parties when changes occur, explaining why the changes were necessary and defining how they may impact financial reporting can build trust and minimise misunderstandings. This transparency can lead to better decision-making and improved relationships between the business and its stakeholders.

Periodic Internal Audits

Internal audits are preventative assessments of a company’s performance and processes that reveal how effectively the business is running. With periodic internal audits, financial teams can remain confident that they are working with the most up-to-date information, best practices and regulatory standards when recognising revenue. These internal audits are typically conducted by financial experts within the company or outsourced to relevant third parties, under the direction of company management. Like their external counterparts, internal auditors require access to both quantitative and qualitative information to gain a comprehensive understanding of the business’s revenue recognition system. Their review and analysis of that information can disclose shortcomings, identify problems and find areas where improvements are necessary to maintain accurate financial records and comply with regulatory requirements. For example, an internal audit might reveal that a company has been recognising revenue too early, leading to inflated financial reports. By correcting this, the company’s financial statements will better reflect actual business performance.

Documentation and Backup

Proper documentation backs up all transactions, creating an accurate and traceable record of a company’s financial activities. Documentation should include contract and service delivery terms, as well as revenue recognition. Detailed records help analysts track how closely projects adhere to their original budgets and contract terms and can help companies create more accurate future estimates and expectations. After creating the documents, make sure to back them up securely so that relevant information remains easily accessible for audits and other reviews and can be applied to future decisions. Backup systems protect a firm from the risk of data loss.

Engage With Industry Peers and Experts

Connecting with industry peers and experts can help business leaders share insights, discuss challenges and learn from others’ experiences, especially in complex areas like revenue recognition for professional service businesses. Staying up to date with the latest trends, strategies and best practices can be challenging and overwhelming for isolated businesses, so many decision-makers participate in industry forums, webinars, conferences and roundtable discussions to facilitate knowledge-sharing and foster relationships that can lead to collaborative problem-solving and new ways of thinking. Make this practice an ongoing process, as it can present an important contribution to continuous learning and improvement in revenue recognition practices — and other fields that are vital to a business’s success.

How Can Software Improve the Revenue Recognition Process?

Good accounting software can offer numerous ways to enhance a professional services firm’s efficiency, starting with the ability to align transactions with guidance from the current accounting standards as well as the business’s internal revenue recognition policies. This can save significant time for staff because it automates many of the error-prone manual tasks associated with revenue recognition, including scheduling changes in project life cycles and generating financial statements at predetermined times. For fast-growing professional services businesses, manual revenue recognition rapidly becomes unmanageable as the number of projects with multiple deliverables (i.e., performance obligations) begins to rise. Software also enhances the accuracy of estimates and contract terms by generating complex revenue calculations for forecasting and resource allocation. These improved calculations underlie truer initial estimates for upcoming projects and help with reviews of current projects.

Revenue Recognition Schedule

NetSuite Couples Core Accounting Functions With Compliance Management for Professional Services

To effectively manage revenue, financial professionals require robust data, customisable scheduling controls and visibility into every project they work on. With NetSuite’s cloud accounting software, professional services businesses can access a complete view of their financial performance and cash flow. NetSuite allows accountants — and project managers — to track incoming payments, recognise revenue when and as appropriate, and review up-to-date cash flow metrics. Accounting teams can use NetSuite’s automated accounting tools and comprehensive data to improve financial controls and generate accurate reports quickly, giving business leaders detailed, real-time insights into performance.

With NetSuite’s cloud-based system, project data can be integrated and accessible from anywhere, ensuring that every service team member is operating on the same page, with the same information. NetSuite’s platform also gives businesses tools to track key performance indicators (KPIs) and find areas where they can improve operations, streamline processes and quickly pivot should problems arise or market forces evolve. With NetSuite, businesses can focus less on when and how to recognise their revenue and more on earning it.

Professional services firms are in business to make a profit serving customers, but tracking and monitoring their profitability is complicated by the challenges they face adhering to revenue recognition rules. These rules make tracking revenue especially challenging for businesses that provide services with complex payment schedules and multistage performance obligations. By following consistent revenue recognition practices, aided by accounting software that incorporates standards-based guidance and automates revenue recognition processes, professional services firms can more effectively account for their diverse revenue streams, determine when revenue is rightfully earned and properly record it in their books — ultimately leading to a more transparent and accurate view of business performance.

#1 Cloud

Accounting

Software

Revenue Recognition for Professional Services FAQs

How is professional services revenue recognised?

In professional services, revenue is recognised when the service is fulfilled. For services delivered in stages or on an ongoing basis, companies must meet specific deliverables or milestones, such as percentage of project completed, before revenue can be recognised. In some cases, revenue will not be recognised until the final products are completed and delivered to customers.

What is revenue in professional services?

Revenue in professional services firms is generated by charging clients for services based on specialised knowledge, expertise and skills in various fields, such as law and accounting. This revenue typically comes from fees for specific deliverables and reflects the value received by clients. Service revenue can be separated into different aspects of the service, such as multiple phases where goods are delivered, and revenue should be recognised as those phases are completed.

What is the revenue recognition principle for services?

The revenue recognition principle for services is based on accrual accounting and states that revenue should be recognised when earned, as services are performed, regardless of when cash is exchanged. This helps give a more realistic picture of the value and timing of the professional services offered by the business, rather than focusing on cash flow and when invoices are paid.

What are the five criteria for revenue recognition for professional services contracts?

The five criteria for revenue recognition under joint U.S. and international accounting standards are:

- Identifying the contract with a customer.

- Identifying the contract’s performance obligations.

- Determining the transaction price.

- Allocating the transaction price.

- Recognising revenue when/as performance obligations are satisfied.

How is consulting revenue recognised?

Consultants recognise their revenue over the duration of a project to better reflect the ongoing service being provided. An IT consultant hired for a yearlong project, for example, would recognise one-twelfth of the project’s revenue every month for the year. This ongoing revenue recognition provides a more accurate reflection of the firm’s projects, earnings and financial stability over time.