Traditional cash registers may have ceded checkout space to sophisticated point-of-sale (POS) systems — with or without cashiers — but ensuring that the amount of money collected from customers matches a business’s corresponding sales receipts remains as important as ever. Cash reconciliation, typically conducted at the end of a worker’s shift or at the end of the business day, is the process of comparing the cash on hand to the recorded cash transactions. The amounts should match. If they don’t, a business must determine why and, if unable to reconcile, properly account for the loss in its financial record.

To avoid a similar outcome, businesses should make sure they understand the steps involved in cash reconciliation, best practises to support the process and the advantages of automation. Of note, “cash” refers not only to physical currency but also to checks, credit and debit cards, electronic fund transfers, digital wallets and mobile payments, such as Venmo.

What Is Cash Reconciliation?

Cash reconciliation is a type of account reconciliation(opens in a new tab) that verifies that receipts from sales transactions made at the point of sale equal the amount of physical cash, checks and other forms of payment found in the POS terminal. If the totals don’t align — say, for example, a register comes up $300 short as compared to its sales receipts — a business must determine why and properly account for the loss in its financial records.

Key Takeaways

- Cash reconciliation detects inconsistencies in the amount of cash a business has on hand and its internal financial records, aka sales receipts.

- Cash reconciliation is a multistep process that helps reduce the likelihood of errors or misrepresentations in a company's financial statements.

- A cash reconciliation sheet is a financial document used to document discrepancies and adjustments.

- Automation can free staff from performing most of the mundane steps involved in cash reconciliation.

Cash Reconciliation Explained

To err is human. Mistakes at a physical register or POS terminal can happen for a multitude of reasons. For example, a clerk might miscount change (doling out too much — perhaps two bills stuck together — or too little), accept a counterfeit bill or enter the wrong payment type. Theft can also occur, be it at the hands of the clerk or a manager who counts the till at the end of a shift. Outdated software that, for example, incorrectly calculates change or an error occurring during payment processing are other possibilities. But no matter the cause, the end result will be a discrepancy between the amount of money in the register and the tally of the register’s sales receipts.

Cash reconciliation is the process of comparing the cash on hand to the recorded cash transactions at the end of the day or a person’s shift. If the amounts don’t match, even after a recount, a manager, business owner or accountant will need to investigate the cause and, if the discrepancy can’t be resolved, credit or debit(opens in a new tab) the appropriate general ledger (GL)(opens in a new tab) account.

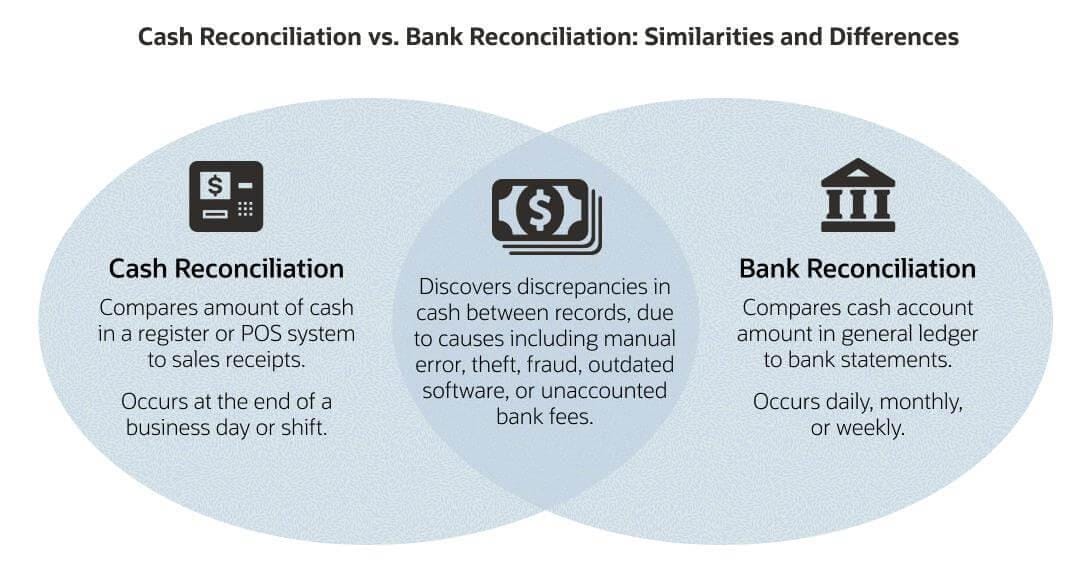

Cash Reconciliation vs. Bank Reconciliation

Bank reconciliation(opens in a new tab) is another type of account reconciliation that looks at both incoming cash (deposits) and outgoing (payment). Like cash reconciliation, its purpose is to catch cash discrepancies, except that it involves matching the cash balance recorded in the business’s GL to its bank statements. Bank reconciliations can catch deposits in transit and unrecorded service and transaction fees, such as when a check bounces. Cash reconciliation compares the amount of cash in a register to transaction receipts. It occurs before sales figures are posted to the GL.

Why Is Cash Reconciliation Important?

Cash reconciliation is one piece of the overall financial management puzzle that confirms a business has the amount of cash it thinks it does. Without confirmation, the business could easily overspend, lose cash, create inaccurate financial statements and incur other negative consequences. Moreover, the reasons behind the discrepancies would go undiscovered, perpetuating the problem. Here are some reasons why cash reconciliation is important:

- Catch fraud: Cash reconciliation catches innocent mistakes, like miscounted change, but it can also uncover fraudulent activities(opens in a new tab), such as employee or management theft, embezzlement, unauthorised transactions and payment fraud. Without cash reconciliation, incorrect balances can make their way into a company’s GL and financial statements, leading to misinformed decision-making, misrepresentation to interested parties, such as investors and lenders, and damage to brand reputation and loyalty.

- Avoid accounting errors: Accounting errors(opens in a new tab) may not be 100% unavoidable, especially when tasks and processes are handled manually, but they can ladder up to the consequences described above. Cash reconciliation catches cash discrepancies before they make their way to the company’s GL and snowball into more serious accounting errors.

- Forecast more accurately: Financial forecasting is the process of predicting future financial performance, based on current and historical data and external events. Incorrect data can impair a forecast, such as predicting cash flow, as well as the decisions made using it. Cash reconciliation is one of several ways a business can ensure that its forecast is accurate.

- Generate accurate tax returns: Taxes are the cost of doing business. In the U.S., for example, all businesses must submit an annual income return, either directly or through its owners’, based on their total income minus deductions. Cash reconciliation verifies that cash sales are properly accounted for and recorded, which in turn ensures the information on the tax return is accurate. It also supplies the necessary documentation, in the form of sales receipts, should the business be audited.

- Confirm financial statement accuracy: Business executives, shareholders, lenders and other stakeholders rely on financial statements(opens in a new tab) to understand a company’s financial health. Every “i” must be dotted and every “t” must be crossed. Cash reconciliation can help prevent the production of statements that misrepresent a company’s cash position.

Steps in the Cash Reconciliation Process

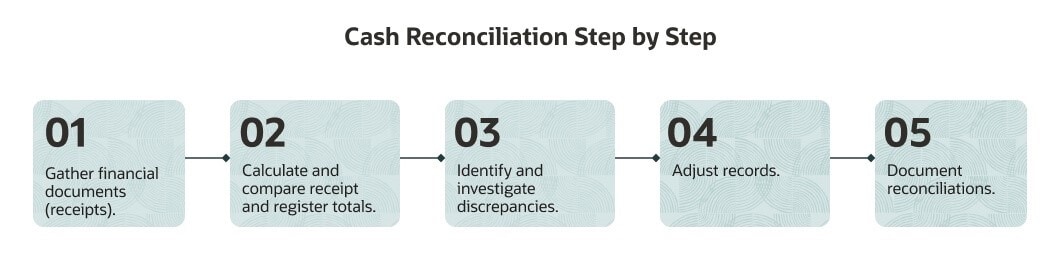

Cash reconciliation is typically a five-step process that can be performed manually or be automated through software. The latter approach frees up staff time by involving personnel only when they are needed to investigate and rectify discrepancies. Here’s how the cash reconciliation process works.

- Gather financial documents: For cash reconciliation, the financial documents needed are the sales receipts.

- Calculate and compare receipt and register totals: Add up total sales recorded in sales receipts and count the amount of cash in the POS terminal.

- Identify and investigate discrepancies: Ideally, the totals will match. But it’s not uncommon if they don’t. If that’s the case, you’ll need to double-check the math, review the transactions and look for reasons for the discrepancies.

- Adjust records: Once those reasons are found, the records can be adjusted to reflect any corrections.

- Document the reconciliation: Produce a cash reconciliation form that breaks down cash balances and fully outlines reconciliations and adjustments. Transactions that couldn’t be reconciled should be noted as well.

Cash Reconciliation Best Practises

How can a business ensure that cash reconciliation goes as smoothly and efficiently as possible? The obvious answer is to turn it over to software that can handle the most tedious and time-consuming aspects of the process. Here are some additional best practises.

- Create a standardised process: Establish a repeatable process for recording, documenting and reconciling discrepancies that arise. This will help streamline the process, minimise errors and facilitate employee training.

- Perform cash reconciliation regularly: Maintaining an active cash reconciliation practise — daily, at a minimum — keeps the volume of errors from mounting, as the primary objective is to identify discrepancies as swiftly as possible.

- Apply segregation of duties: The person working a register should not be the person who performs cash reconciliation. This so-called segregation, or separation, of duties is an important internal control — think checks and balances — that aims to prevent theft and fraud by dividing responsibilities among two or more individuals.

- Use an independent auditor: Enlisting the services of a third-party, licenced professional may yield more precise results than handling cash reconciliation internally, though practically speaking, an auditor is much more likely to review data from the POS system on a quarterly or annual basis, as well as financial statements.

- Invest in security: A security system that incorporates video surveillance can catch dishonest employees in the act of their misdeeds. POS software can also track cashier performance and uncover trends in transactions that could point to something suspicious.

Cash Reconciliation Example

Consider a simple scenario involving a brick-and-mortar store named Howard’s Hardware. Business is booming, and like any smart businessperson, Howard wants to close out each day making sure his documented sales transactions, in the form of sales receipts, align with his actual cash intake.

On this particular day, Howard opens for business with $250 in the register and closes with $500. He had only one cashier working at the register. Since he isn’t using software, Howard manually adds up the sales receipts to ascertain how much he made and in what forms of payment. His cash reconciliation statement, which categorises transactions, might look like this:

| Receipts | Sales | Total |

|---|---|---|

| Beginning cash | $250 | |

| Cash sales | $250 | |

| Check sales | $75 | |

| Credit card sales | $325 | |

| Digital wallet | $150 | |

| Mobile payment | $100 | |

| Total sales | $900 | |

| Cash received | $250 | |

| Total cash in register | $500 |

Next, Howard physically counts the amount of cash in the register and compares it to the ending balance on the cash-out form. If the numbers match, he’s done for the day. If they don’t — perhaps, at the end of the day, there is only $425 in the register — he’ll have to try to track down the reason. In this case, he realises that he mistakenly entered the wrong payment type for the $75 transaction, choosing cash when he should have selected check. In other words, check sales should have been $150. He updates his records and heads home.

Automating the Cash Reconciliation Process

Cash reconciliation may not require complex calculations — mainly addition and subtraction — but handled manually as a business grows, the process becomes increasingly cumbersome and fallible. It can also ultimately delay the financial close process(opens in a new tab) and affect the accuracy of financial statements. Like many other financial processes, cash reconciliation is ripe for automation with the right financial or accounting software, which streamlines workflows, flags concerning activities and minimises staff involvement to mainly investigate discrepancies.

Automate Your Cash Reconciliation Process With NetSuite

Automating as many accounting and financial functions as possible can save teams countless hours of manual work. NetSuite Cloud Accounting Software fits that bill by automating repetitive tasks, including payment reconciliation, journal entry creation, accounts payable and receivable, and tax calculations. Its rich reporting functionality helps business owners and executives stay on top of key performance indicators that lead to well-informed decisions based on accurate, real-time data and clear visibility of cash flow. The solution also ensures regulatory compliance.

Used routinely, cash reconciliation ensures that sales receipts and cash on hand match. The five-step process can be performed manually or be handled by tailor-made software, but either way, it offers many advantages, from detecting fraud and accounting errors to simplifying financial forecasting and generating accurate tax and financial statements. By adhering to best practises and, when possible, automating repetitive tasks with software, regular cash reconciliation can keep costly discrepancies at bay.

#1 Cloud

Accounting

Software

Cash Reconciliation FAQs

What are the steps of cash reconciliation?

Cash reconciliation can be broken down into five individual steps: Gather financial documents (sales receipts), calculate and compare balances, identify and investigate discrepancies, adjust records and document reconciliation.

What is a cash reconciliation sheet?

A cash reconciliation sheet is a document that compares the cash balance in a register or point-of-sale terminal to sales receipts, performed at the close of a shift or the end of the business day.

How do you prepare a cash reconciliation statement?

Cash reconciliation begins by gathering all of the sales receipts for the day or shift. Add together the separate receipt totals to determine the total amount of sales made that day. Then count the cash in the register and compare it to the sales receipt total. If the totals don’t match, you’ll need to investigate the discrepancy. Once identified, records can be adjusted to reflect one or more reconciliations. Last but not least, everything needs to be documented, including unreconciled transactions.

Who is responsible for cash reconciliation?

Responsibility for cash reconciliations depends on the size of the business. In small or midsize businesses, the job might fall to the business owner or a specific manager, while at a large organisation someone from the finance or accounting team will be in charge.

What are the different types of cash reconciliation?

Cash reconciliation is a type of account reconciliation. Other types include bank reconciliation, credit card reconciliation and digital wallet reconciliation. All types share the same goal: ensuring financial accuracy.