Tracking and predicting business performance can be challenging for any company. That’s especially true for fast-growing software-as-a-service (SaaS) companies and startups operating under rapidly changing business conditions. Bookings, billings and revenue are three key financial metrics that allow companies to monitor, understand and forecast their business performance. Each sheds light on a different aspect of the company’s financial health. When combined, they provide insights into the company’s current business trajectory, future growth prospects and cash flow.

What Are Bookings, Billings and Revenue?

Bookings, billings and revenue are three important measures of a company’s sales and overall financial performance. Each of these business metric (opens in a new tab)s highlights a different facet of the company’s financial health. Here’s how they differ:

- Bookings are the value of contracts signed during an accounting period. For SaaS companies, bookings are the total amount that customers have committed to pay for subscriptions and other services, such as training and implementation, throughout the life of their contracts, which can span multiple years. Thus, bookings are a key indicator of future revenue growth.

- Billings are the amount of money the company has billed customers for during the accounting period. Billings are typically a good indicator of the company’s cash flow because they represent money the company expects to receive soon. For SaaS companies, billings include recurring subscription fees, plus any charges for other services, such as consulting.

- Revenue is the amount the company has earned during the period. This often differs from the amount billed. Companies using accrual-based accounting earn revenue as they deliver the services or meet other obligations specified in the contract — not when they bill customers or when they get paid. Take the example of a SaaS provider that bills a customer in advance for a year’s SaaS subscription. The supplier only earns that revenue gradually, over the course of the year, as it delivers the contracted services. Each month, its revenue from the contract is one-twelfth of the annual subscription cost.

3 Key Sales Metrics

| Metric | Definition | Importance |

| Bookings | The value of signed contracts. | Illustrates future business growth. |

| Billings | How much the company bills its customers. | Indicates cash inflows. |

| Revenue | How much the company has earned by delivering products and services. | Required for reporting and for tracking current financial performance. |

Together, bookings, billings and revenue provide a picture of the company’s current sales, overall business strength, growth prospects and cash inflows. Managers, investors and lenders closely scrutinise these metrics to understand the company’s financial performance. For example, a huge surge in bookings is a strong indicator that the company will grow rapidly and that its billings and revenue will increase.

However, the fact that bookings, billings and revenue tallies can differ greatly from each other means that groups within the company may have divergent views of the business’s financial performance. This can result in misunderstandings and poor business decisions if the relationship among the metrics isn’t clearly understood.

It’s also important to examine other financial metrics (opens in a new tab) to gain a fuller understanding of a SaaS company’s performance. For example, a SaaS company’s (opens in a new tab) income may include regular payments derived from a subscription model (opens in a new tab), as well as one-time payments for system setup or training. Both types of income are reflected in the company’s total bookings, billings and revenue numbers. Managers and investors often focus on the recurring subscription payments because they represent the most sustainable source of cash.

Customer churn (opens in a new tab) — the rate at which a company loses customers — is another closely watched metric. If a company is losing customers faster than it’s winning new ones, it’s often a sign of problems. For example, customers may be leaving because they’re dissatisfied or because new competitors are tempting them with a superior product. A high churn rate may be a warning sign that bookings, billings and revenue will fall in the future.

Key Takeaways

- Bookings, billings and revenue are three important sales metrics for SaaS providers and other companies. Each highlights a different aspect of the company’s financial health.

- Bookings are the total value of signed contracts. They are a measure of future income and business growth.

- Billings enumerate the amounts billed to customers. They are a predictor of cash inflows.

- Revenue is the money earned by delivering products and services. It includes recurring subscription revenue, as well as one-time charges.

- By examining all three metrics, managers, investors and lenders can gain a more complete picture of a company’s current and future performance.

Revenue Recognition Explained

Revenue recognition (opens in a new tab) is an accounting principle that determines how companies record revenue and report it in their financial statements — specifically, when the company has earned it. Typically, that means the point at which the company has fulfilled its obligations to the customer and knows how much it will receive in return — for example, after the company has delivered a product that the customer ordered for an agreed-upon price. The goal of revenue recognition is to accurately and consistently represent the company’s financial performance, which is especially important for SaaS companies that may collect the full price of an annual subscription up-front but can only recognise a month’s worth at a time.

Accounting Standards Codification (ASC) 606, part of the Generally Accepted Accounting Principles (GAAP), provides standardised guidance for how U.S. companies should recognise revenue. It involves a five-step framework:

- Identify the contract with the customer, in which all parties approve the contract and agree to meet their obligations, among other criteria.

- Identify the performance obligations in the contract. For a SaaS provider, a sales contract might include a two-year commitment to supply a SaaS software subscription, plus implementation and training fees.

- Determine the transaction price as detailed in the contract.

- Allocate the transaction price to the performance obligations. Determine how much of the total contract value is allocated to the software subscription, to training and to implementation.

- Recognise revenue as the performance obligations are satisfied. A SaaS provider recognises revenue as it is earned for each item defined in the contract. For example, it might recognise the revenue for training and implementation when it has finished providing those services. It recognises a portion of the subscription revenue at the end of every month over the two-year life of the contract.

What Are Bookings?

Bookings are a forward-looking metric that shows how much revenue the company expects to receive in the future. Bookings represent the value of customer contracts signed, even if the company hasn’t yet received any payment or delivered any products or services. Bookings are typically recorded as soon as an agreement is signed and include deals with new customers, as well as contract renewals. Each contract may include multiple types of products and services delivered over different periods. For example, if a company wins a two-year contract worth $10,000 and a five-year contract worth $40,000, its total bookings are $50,000.

It’s important to remember that bookings don’t always result in receiving all of the revenue specified in the contract. For example, a customer might cancel before the end of the contract or be unable to pay for other reasons.

The Importance of Bookings in SaaS

Bookings are a critical metric for SaaS providers because they provide a view of the company’s likely growth trajectory. Startups, for example, may have relatively little revenue in their early lives. But if they offer compelling products, customers may be willing to commit to contracts that will bring in significant revenue over the long term. The company’s bookings are a window into the company’s success in customer acquisition and expected pipeline value.

As a SaaS company becomes more established, trends in bookings can help the company improve its key assumptions about longer-term trends in revenue and create an achievable operating plan. If bookings rise, revenue will usually increase later, as the company delivers the contracted services. Bookings growth often signals a strong market demand for the company’s products. Conversely, a decline in bookings may be a warning sign that the company is having problems attracting new customers or getting existing customers to sign new contracts, so revenue is likely to fall in the future.

What Are Billings?

Billings are the amount a company bills its customers each period. Billings provide a view of the business from a cash flow perspective (opens in a new tab) because companies generally expect to receive payment soon after they bill their customers. Billings aren’t guaranteed to result in equivalent cash inflows, however, because some bills may be uncollectible. In addition, the amount billed by a company doesn’t always reflect all the products or services it has provided during the period. For example, it may bill customers in advance for services it will provide later.

The Importance of Billings in SaaS

Billings are a critical measure of a SaaS’s ability to generate the cash needed to fund everyday operations and business growth. Billings can include charges for a variety of different products and services. Recurring charges for SaaS subscriptions are often the most important component of a bill. Companies watch for trends in these recurring charges because they reflect the health of the company’s core business; steady growth in recurring billings is a sign that the company’s customer base is expanding and/or that customers are subscribing to more of the company’s products. Some SaaS companies accelerate cash flow by billing in advance for the full amount of their annual subscriptions. Billings can also include charges for other services, such as initial fees for training or product setup.

What Is Revenue?

Revenue (opens in a new tab) is the money that a company earns from the sale of goods or services. Revenue is defined as the total value of sales minus any returns, discounts or other allowances. For any company, revenue is one of the most critical measures of financial health and performance. It’s the first item listed on the company’s income statement (opens in a new tab), which is why revenue is also known as the “top line.”

Organisations using accrual accounting recognise revenue when it has been earned, regardless of when customers are invoiced or when payments are received. A company is considered to have earned revenue when it has delivered the corresponding product or service. Unlike bookings and billings, revenue is a GAAP metric. Companies that need to follow GAAP accounting guidelines (opens in a new tab), including publicly listed companies, need to follow the guidance outlined in GAAP ASC 606 when reporting revenue. The guidance is designed to ensure that companies report revenue in a way that’s consistent with and comparable to other companies.

The Importance of Revenue in SaaS

For SaaS providers, revenue is a critical measure of their ability to create a solid, sustainable business. That’s why revenue is a closely watched metric for managers, investors, lenders and analysts. Lenders and investors, for example, scrutinise a company’s revenue when determining whether to provide funding.

In contrast to bookings, which highlight the company’s future potential, revenue measures growth that has already occurred, because companies record revenue only when they have earned it. For example, SaaS providers record recurring subscription revenue at the end of every month in which they have earned the revenue by delivering the corresponding services. If they bill customers for a year’s subscription in advance, they spread the revenue over the year.

For many SaaS companies, the most important component of the revenue model is the steady revenue generated by subscriptions. SaaS companies often have customer contracts of varying lengths, so they track revenue trends by calculating the revenue generated each month or each year, known respectively as monthly recurring revenue (MRR) and annual recurring revenue (ARR). These metrics provide a consistent way to track trends in subscription revenue regardless of the length of individual contracts.

How Businesses Report Bookings, Billings and Revenue

For SaaS companies, bookings, billings and revenue are all important metrics. Depending on the company’s sales and operating model, the three metrics can differ widely. For example, a new company with an innovative product may win a large value of bookings, even though it has little or no revenue at all. So, it’s important to analyse all three metrics to get a true picture of the company’s performance.

When a company bills in advance for services that it hasn’t yet delivered, it records the value of the as-yet undelivered services as deferred revenue (opens in a new tab), which is a liability on the company’s balance sheet (opens in a new tab) . Take the example of a company that bills a customer in advance for a $12,000 annual subscription. Until the company starts delivering the subscribed services, the contract value is considered deferred revenue. The company earns the revenue from that contract over the course of the year, so, at the end of each month, it records $1,000 in revenue and reduces the deferred revenue by the same amount.

It’s also vital for companies to track every contract at each stage, from booking to billing and recording revenue, so that their SaaS accounting (opens in a new tab) records truly capture what’s happening in the business operations and making sure that no money slips through the cracks. Accounting automation (opens in a new tab) can help companies accurately track financials throughout the entire sales and service delivery cycle.

SaaS bookings, billings and revenue example

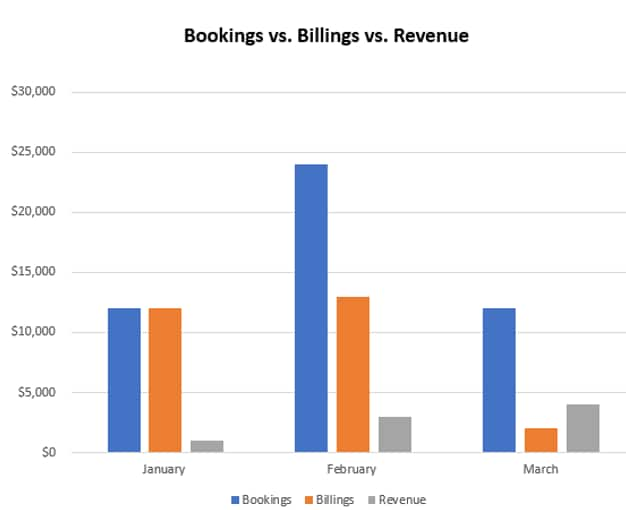

Here’s an example, based on a fictitious SaaS company, that illustrates the potential differences among bookings, billings and revenue. To keep it simple, we’ll imagine that each customer commits to a one-year subscription contract with a $12,000 total contract value, but two clients pay the full amount in advance while two others pay monthly.

| Customer | Contract date | Payment frequency | Initial payment | Recurring monthly payment | Annual contract value |

| Acme Products | January 1 | Annual in advance | $12,000 | 0 | $12,000 |

| Beta Fish | February 1 | Monthly | 0 | $1,000 | $12,000 |

| Carrots R Us | February 1 | Annual in advance | $12,000 | $0 | $12,000 |

| Dazzling Deals | March 1 | Monthly | 0 | $1,000 | $12,000 |

The bookings each month are the total value of all contracts signed that month, regardless of how the customers pay for their subscriptions:

| Bookings | ||

| January | February | March |

| $12,000 | $24,000 | 12,000 |

Billings are the total amount billed each month. For customers paying a year’s subscription in advance, that equals the full $12,000 value of the annual contract; for others, it’s a $1,000 monthly charge:

| Billings | ||

| January | February | March |

| $12,000 | $13,000 | $2,000 |

At the end of each month, the company records the revenue it has earned from delivering subscription services during the month. For customers that paid a year’s subscription in advance, the revenue is calculated as one-twelfth of the annual payment. For customers that have opted to be billed monthly, the revenue matches the amount billed.

| Revenue | ||

| January | February | March |

| $1,000 | $3,000 | $4,000 |

As this example shows, bookings, billings and revenue can present very different views of the company’s financial performance. The SaaS company’s bookings highlight the company’s field sales momentum and potential future revenue. Billings show the incoming cash flows that the company expects each month. Revenue trails the other two metrics, yet its growth demonstrates the steady expansion of the business, based on how much the company actually earns each month.

SaaS Accounting Made Easy With NetSuite

NetSuite’s cloud-based enterprise resource planning (ERP) suite provides comprehensive accounting software that allows SaaS companies to manage their financials with increased efficiency and speed. NetSuite automates and streamlines accounting tasks, helping companies eliminate time-consuming, error-prone manual steps, while accelerating key financial close processes. NetSuite automates revenue recognition, enabling SaaS companies to track complex revenue models, ensure accurate financial reporting and comply with accounting standards, including ASC 606 and IFRS 15. Companies have real-time visibility into financial data that helps them make informed decisions and react quickly to fast-changing market conditions. SaaS providers can monitor a broad range of standard financial metrics and create custom metrics that match their business needs, ensuring that they can accurately track bookings and billings, as well as revenue. Forecast plans are created automatically for each contract so that companies can improve their forecast accuracy and update projections as revenue is recognised.

Billings, bookings and revenue are all important metrics that provide insights into a company’s financial performance. Analysing these metrics individually and in combination helps businesses gain a better understanding of both their growth potential and their current performance. This helps SaaS providers and other companies make considered, well-informed decisions that drive future growth and profitability.

#1 Cloud

Accounting Software

Bookings, Billings and Revenue FAQs

What does bookings mean in finance?

Bookings are the value of contracts won by a company. They represent future revenue, so they’re a good indicator of the company’s potential for growth. For any period, the total value of bookings can include contracts of different types and spanning different time frames. The revenue from those bookings is often generated over a long period.

What are bookings vs. revenue?

Bookings and revenue are both important financial metrics. They reflect different stages in the process of selling and delivering products and services. Bookings are the value of contracts signed within a specific period. Companies generate revenue over time as they deliver the services and products specified in those contracts. They recognise revenue as they earn it, meaning, after they have delivered on their obligations to customers.

What is the difference between backlog and bookings?

The terms bookings and backlog have some similarities but differ in meaning. Bookings refer to the value of the deals agreed upon by a company and its customers. Typically, bookings represent work that the company will undertake in the future, so it’s a measure of future income. Similarly, a company’s backlog represents orders it has received but has not yet executed. However, the term implies that the company is not able to immediately start work on those orders because of some constraint, such as a lack of skilled staff or raw materials.

How do you convert bookings to revenue?

Companies convert bookings into revenue when they fulfill the obligations to customers as spelled out in sales contracts. For example, a company’s bookings might include a deal to supply five different products over time, each priced individually. After delivery of each product, the company recognises the revenue that was allocated to that product in the contract.

Rebeca Bichachi

Rebeca Bichachi