NetSuite 2024 Release 2 contains a host of new features designed to help companies optimise their business performance, including increased visibility into workforce costs, improved bill capture accuracy, and more banks that can be directly connected to NetSuite. Just one example: It’s now easier to create a data visualisation of your whole order-to-cash workflow, using NetSuite data to spot any cash inflow problems. All of these enhancements are focused on helping finance and accounting teams in their integral role of growing revenue, driving cost efficiencies, and steering the business forward.

Connect to More Financial Institutions

NetSuite 2024.2 lets businesses directly connect to more banks in the US and Canada. NetSuite’s partnership with a new financial aggregator allows for connections to over 14,000 financial institutions. It also provides Open Authorisation (OAuth) connections to over 700 banks, allowing for a stable, secure connection with less frequent re-authentication.

With this partnership, more NetSuite customers can connect their bank and credit card accounts to NetSuite through the Bank Feeds SuiteApp. Data flows automatically from the bank into NetSuite cloud accounting software, providing businesses access to benefits such as automated reconciliation of bank and credit card statements with the general ledger and access to up-to-date financial data to make informed decisions around how to allocate cash.

Increased Functionality in Subscription Management

NetSuite 2024.2 includes several new pieces of functionality in NetSuite SuiteBilling to ease subscription management. NetSuite SuiteBilling now includes prepay functionality. This allows companies with a consumption-based pricing model to charge in advance for services, which the customer can then consume over the course of their contract period. Subsequent invoices will inform the customer of the amount of prepayment remaining. If the contract requires the customer to keep a credit balance, NetSuite can be configured to automatically replenish the prepayment based on a minimum threshold.

This release also integrates NetSuite’s configure, price, and quote (CPQ) solution with NetSuite SuiteBilling, allowing companies to include subscription items for products or services in the configuration process. The integration of these two solutions makes them more cohesive and efficient, as well as expands the types of configurable solutions available for sale.

More Visibility Into Talent Costs

Several new features in NetSuite SuitePeople are designed to help companies accurately track and manage workforce-related costs in real time, as well improve compliance and employee productivity.

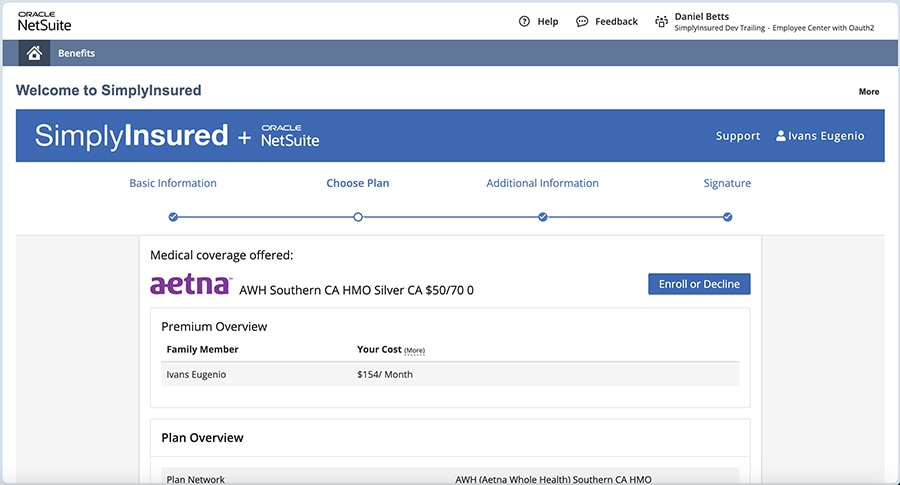

With this release, NetSuite SuitePeople includes a new integrated benefits partner, SimplyInsured—a platform through which businesses can provide employee health insurance. This integration means new hires and existing employees can simply log into SuitePeople’s employee centre to sign up for health benefits. Any deductions are automatically taken from employee pay during the payroll process and costs are posted to the general ledger for tracking. This reduces the hands-on work for tracking employee health insurance costs and gives financial leaders better insight into healthcare costs to make more informed workforce and benefits planning decisions.

NetSuite 2024.2 also includes enhancements to the NetSuite SuitePeople Workforce Management(opens in a new tab) mobile app. Updates to the

time clock functionality include a break completion reminder to help ensure employees take

their full break, as well as new time fields to capture data such as location, job, project,

and task. With more work details included in an employee’s timesheet, finance teams

can make better decisions about resource allocation.

New Close Task Management Capabilities

In this release, there is a new interactive task management feature in NetSuite Account Reconciliation that builds on the close functionality already in NetSuite. This feature provides accounting teams with a centralised place to create, assign, manage, and monitor tasks around the financial close.

The task management feature enables companies to close their books faster, ensures tasks are executed in the proper sequence, and reduces the time spent on handling exceptions. Calendars automatically roll forward from the prior-year reporting, eliminating the need for manual adjustments.

With an easy, intuitive way to manage the close checklist and monitor the progress of the reconciliation process, accountants have more time to focus on other critical tasks for the business.

Enhancements to Invoice Processing and Payments

NetSuite 2024.2 contains several enhancements to make the vendor payment process run more efficiently with less hands-on work. In NetSuite AP Automation, companies with multiple US subsidiaries can now automate vendor payments for each one and process vendor prepayments directly into vendor’s accounts. Companies can also set a default expense account that automatically captures banking fees and charges.

The latest release also includes increased control and accuracy within NetSuite Bill Capture(opens in a new tab) so companies can capture vendor invoices quickly with less errors. On the scanned vendor list bill page, users can now upload bills with up to 30 pages and delete failed uploads to help keep the scanned vendor bills list organised.

The review bill page in Bill Capture has seen several notable AI-powered enhancements. Improved matching technology compares additional values from purchase orders and alerts you to any variances and added subsidiary, vendor, and location logic increases bill record accuracy. Users can now organise and filter the review bill page by custom segment, improving control and visibility.

Expands Visibility Into Cash Flow Processes

In this release, NetSuite Analytics Warehouse adds new dataset collections—or subject areas—for doing data visualisations of specific business processes. This allows analysts to quickly build visualisations that capture each process from end-to-end and identify inefficiencies or other problems that need to be addressed.

The first new subject area, order-to-cash, combines datasets for customer payment activity, customer refund, order fulfilment, and return authorisation to analyse possible issues to cash inflows. The second, procure-to-pay, combines the item receipt, vendor bill, vendor payment activity, and vendor return authorisation datasets to identify any areas where cash outflows could be managed more effectively. With these new subject areas, companies can improve their visibility into key business processes directly impacting cash flow.

NetSuite 2024.2 also introduces a user-configurable subject area called account analysis to give companies more flexibility in customising how financial information is presented—without the need for data augmentation. It aggregates accounting data for all transaction types, allowing analysts to easily compile valuable information—such as income, expense, and cost of goods sold—for regulatory and statutory reporting. It also can be used to create trend reports for different account types over time and to report on multiple subsidiaries and accounting books.

Additional Features to Maximise Efficiency

In addition to the features listed above, the 2024.2 release also brings several new enhancements, including:

- Simplified revenue distribution for accounts receivable transactions: The Transaction Line Distribution SuiteApp now supports the distribution of transactions on the accounts receivable side, covering transactions such as sales orders, customer invoices, and cash sales. This allows companies to easily distribute revenue from accounts receivable transactions to multiple subsidiaries, departments, or other segments on the fly or based on pre-defined templates.

- Further capabilities in NetSuite SuiteTax: With enhancements to NetSuite SuiteTax, accountants can record taxes between subsidiaries, as well as record payments of tax liabilities to authorities.

- Installment schedules for cash forecasting: The Cash 360 SuiteApp now incorporates installment schedules defined on invoices and vendor bills to facilitate more accurate forecasting of accounts receivable and accounts payable.

- Enhancements to the tiered volume rebates feature: Updates to the Rebates & Trade Promotions SuiteApp lets companies assign forecasts for each tiered rebate, basing accruals on the forecasted tier for better accuracy. Additionally, rebate agreement calculations are now available for purchase transactions, not just sales transactions.

- Updated audit documentation in NetSuite Compliance 360: Enhancements to NetSuite Compliance 360 improve audit documentation by providing more forms for documentation of audits and their findings, the option to attach files and export audit results, and customisable activity portlets.

#1 Expense

Management

Software

Learn More About All the Updates in Netsuite 2024.2

This is only a short summary of some of the new features and updates in NetSuite 2024 Release 2. Read more about what is in the release on our Sneak Peek(opens in a new tab) resource centre or dive deep into the release notes(opens in a new tab). Most importantly, don't forget to request your Release Preview(opens in a new tab) test account for hands-on access that will show you how new features will work with your data, workflows, and customisations.

The preceding is intended to outline our general product direction. It is intended for information purposes only, and may not be incorporated into any contract. It is not a commitment to deliver any material, code, or functionality, and should not be relied upon in making purchasing decisions. The development, release, timing, and pricing of any features or functionality described for Oracle’s products may change and remains at the sole discretion of Oracle Corporation.

Rebeca Bichachi

Rebeca Bichachi