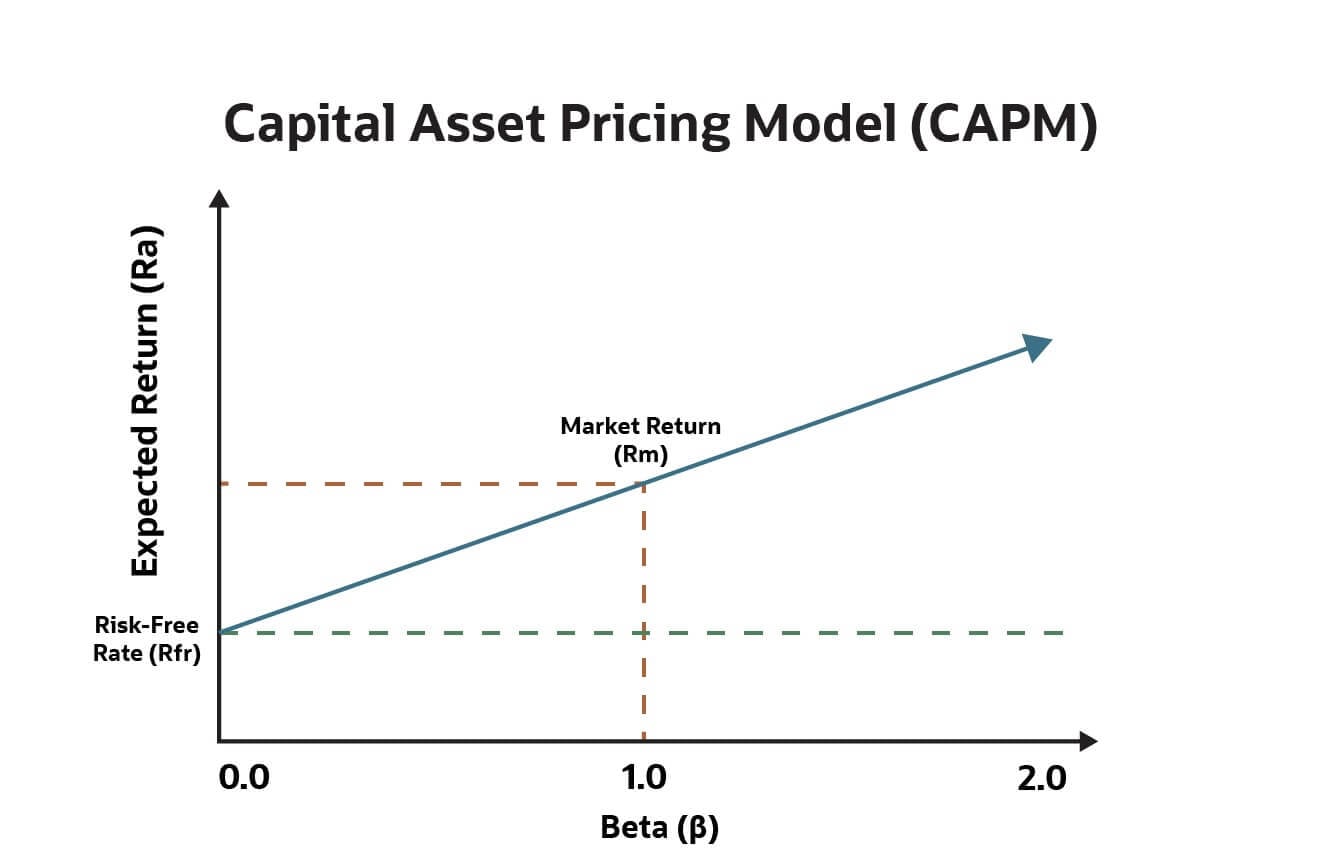

Most investors understand that risk directly correlates with reward. The capital asset pricing model (CAPM) calculates the trade-off between the two elements and is commonly used by portfolio managers and other financial industry professionals when evaluating stocks and other potential investments. By using the expected returns calculated in CAPM, investors can make the decision that is best for them.

What Is the Capital Asset Pricing Model (CAPM)?

CAPM attempts to determine whether the expected returns of an investment are worthwhile, given the associated risk that the investment may not perform as expected. CAPM takes an entrenched, formulaic approach that requires stock market expertise and includes several assumptions about future returns, the unique risks of the investment and the common risks of the market. In addition, savvy business owners who are focused on putting surplus cash to remunerative work sometimes use CAPM for scenarios like investing in securities to earn passive income or investment in other businesses. However, since risk tolerance is a very individualised characteristic, CAPM should be only one piece of an investor’s decision-making process.

Key Takeaways

- The capital asset pricing model measures the expected returns of an investment in light of the investment’s level of risk.

- The model focuses on systematic risk, and its formula includes the risk-free rate, investment beta and the market return.

- CAPM is an established method among investment managers, but it is not without significant pros, cons and oversimplified assumptions.

- Financial software can be helpful in calculating and refreshing CAPM for current and future investments.

CAPM Explained

At its core, CAPM is a way to determine whether an investment’s returns are in balance with its risks. CAPM deals with incremental systematic risk (more on this soon) above certain “risk-free” levels. It is grounded in the economic tenet of opportunity cost(opens in a new tab), which holds that choosing one path inherently means giving up another.

For example, consider a business owner who could either stash away extra funds in a low-risk money market account and earn 1% interest income or invest in a certain stock that might pay higher dividends and appreciate in value over time; the 1% interest income would be forgone if the funds were used to purchase the stock instead. CAPM aims to determine whether the stock’s expected returns are commensurate with the risk of investing in the stock, over and above the opportunity cost of a low-risk or risk-free investment. Lower returns, or returns below a threshold rate as calculated by CAPM, might prompt an investor focused solely on accumulating wealth to pass on the investment. But if the returns are greater than CAPM would indicate, that same investor might move ahead with the investment.

How the CAPM Works

CAPM focuses on systematic risk — that is, risks that impact the entire market and are unavoidable, such as changes in inflation, interest rates or government monetary policies. On the flip side, unsystematic risks can be minimised through investment diversification. They relate to the unique characteristics of the investment, such as industry regulation, capital structure of the business and competition.

CAPM Formula and Calculation

Because some investments appreciate in value while others depreciate, assessing risk is a key factor in choosing where to invest hard-earned capital. The CAPM formula represents a simplified way of determining the expected rate of return for an investment; its components are the risk-free rate (Rfr), investment beta (βa) and market return rate (Rm). The values of each are dynamic, so it’s important to update the CAPM calculation periodically or as factors change, such as when the federal government increases the interest rate. The CAPM formula is:

Expected return = Interest rate on risk-free securities x [investment beta x (market return - interest rate on risk-free securities)]

The formula is represented symbolically as:

Ra = Rrf + [βa x (Rm – Rrf)]

Risk-free rate, or Rrf,

is the interest rate an investor could earn from securities that carry little or no risk. The risk-free rate tends to be low because it is considered a “safe” investment. It can also be thought of as the opportunity cost in return for taking on additional investment risk. Although there are no truly risk-free securities, U.S. Treasury bills are generally considered risk-free because the risk of default by the U.S. government is low. The rates for three-month, three-year and 10-year Treasury bills are commonly used as the risk-free rate, selected to match the length of time the investment is expected to be held. It’s worth highlighting that higher risk-free rates put more pressure on riskier investments to produce even higher returns.

Beta, or βa,

is a value that compares the systematic risk of a particular stock to the volatility of the overall market (“a” represents the particular stock). There are several complicated ways to calculate a stock’s beta, but assorted financial websites also provide published lists of stock betas, often referred to as a “beta score.” The higher the beta, the riskier the stock. Stocks with betas greater than 1 are more susceptible to overall market swings and, therefore, carry more risk. That also means they are expected to give off higher returns. Stock for market disruptors, such as pure technology companies and financial technology companies(opens in a new tab), have historically had betas greater than 1. Stocks with betas of less than 1 are more stable than the overall market and can be helpful in reducing the risk of a portfolio — in exchange for lower returns. The health care and financial services industries typically have betas less than 1. However, it’s important to note that a particular firm’s beta may deviate from industry norms for reasons including specific company characteristics, such as its business model or size.

Market risk premium, or (Rm — Rrf),

is the expected incremental return of the overall market above the risk-free rate. Its component pieces are the market return (Rm) and the risk-free rate (Rrf). The Rm is an estimated return rate of the overall market or of a very diversified portfolio, rather than a single stock. For example, the S&P 500 — a diversified group of 500 of the largest U.S. public companies — had a market return of 59% for the three years ended March 2023. In comparison, the return on a three-year Treasury bill was about 4% in mid-April 2023. The market risk premium — in this case, 55% (59%–4%) — is significant, demonstrating that even a well-diversified portfolio has built-in systematic risk.

Expected return, or Ra,

is the solution of the CAPM equation. It represents the rate of return an investor should expect from an investment in order to balance out the risks of the investment, as compared to the overall market risks and the opportunity cost of risk-free investments. The expected return should be compared to a stated or anticipated return from the investment. If the expected return is less than the investment’s stated or projected return, then the investment is thought to be outperforming its risk. Comparing Ra for multiple investments can be helpful when choosing among investments. The expected return can also be compared to an investor’s required rate of return, although CAPM also factors in risk.

CAPM Examples

Using the CAPM formula is straightforward once all of the variables are assembled. Consider the following example.

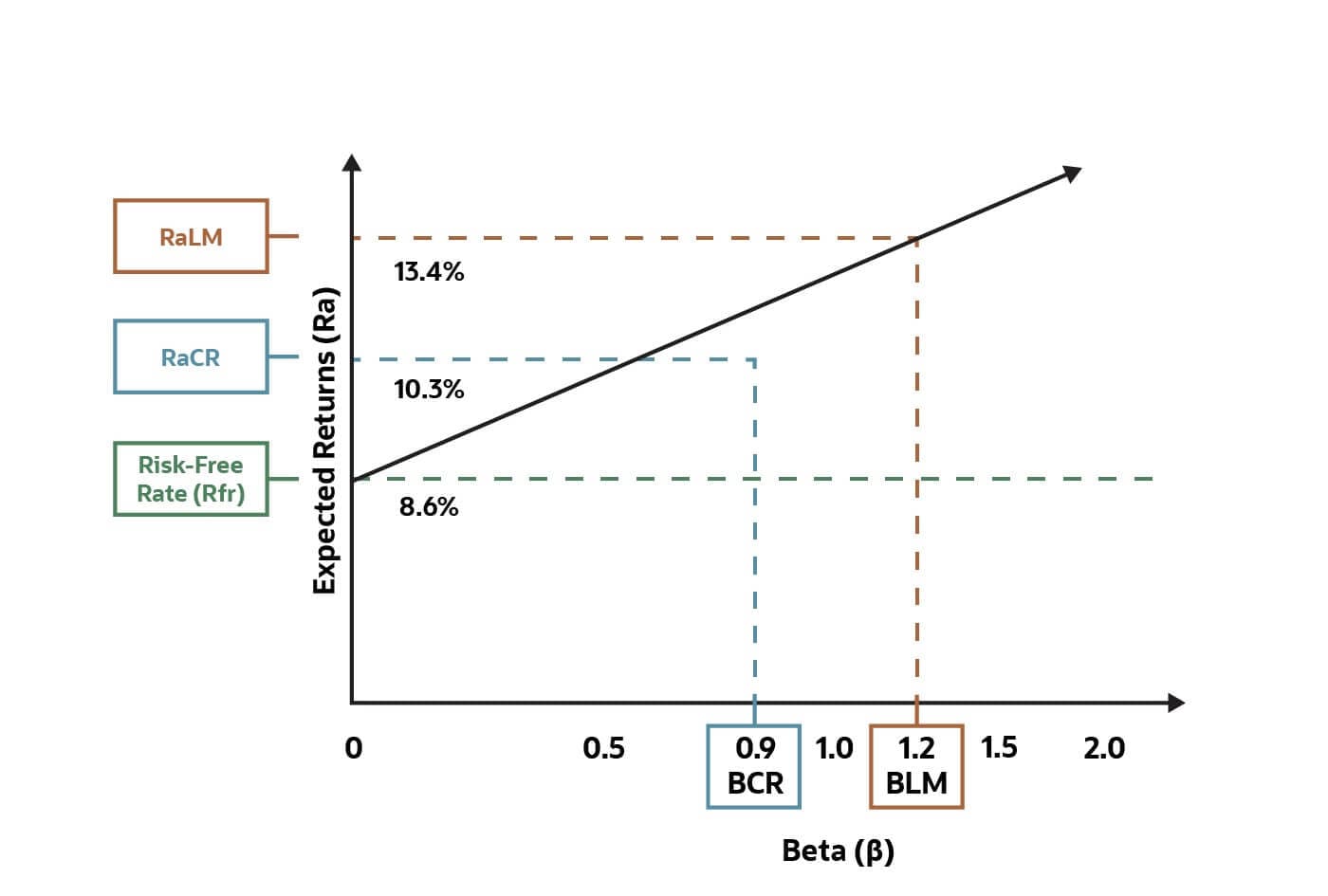

Local retailer KMR Soccer Supply has enjoyed a few years of better-than-expected profitability and has accumulated a cash surplus. KMR’s owner would like to put that surplus to work, earning passive income. She has identified two stocks that she believes might be good investments, with ticker symbols LM and CR. If business continues to go well and the selected investment performs as expected, she plans to hold on to the stock for five years. She uses the CAPM formula to evaluate the expected rate of return of each stock, using the following data:

- The risk-free rate is 8.6% using the five-year U.S. Treasury bill interest rate, as published.

- The return rate for stock LM is 12.6%, based on historical data.

- The return rate for stock CR is 10.5%, based on historical data.

- The LM stock’s beta is 1.2, as published on a leading financial website.

- The CR’s stock beta is 0.9, as published on a leading financial website.

The CAPM for stock LM

is:

Rlm = Rrf + [βlm x (Rlm – Rrf)]

= 8.6 + [1.2*(12.6 –

8.6)

= 8.6 + 4.8

The expected rate of return for stock LM is 13.4%.

The CAPM for stock CR

is:

Rcr = Rrf + [βcr x (Rcr – Rrf)]

= 8.6 + [1.2*(12.6 –

8.6)

= 8.6 + 4.8

The expected rate of return for stock LM is 13.4%.

Comparing the two results, KMR’s owner opts for stock LM, because its expected return is higher than CR’s, all other things being equal. Here is how the CAPMs for both stocks look graphically:

Pros and Cons of CAPM

CAPM was a significant breakthrough when it was first introduced during the 1960s. It is still widely used today, though it has its pros and cons.

| CAPM Pros | CAPM Cons | |

|---|---|---|

| Overall | Focuses on systematic risk, which is unavoidable, even through diversification. | Does not factor in unsystematic risk from catalysts such as industry regulations, competition and capital structure of a business. |

| Relatively simple. | Certain foundational assumptions may be flawed (see next section). | |

| Widely used and easily compared. | ||

| Beta | Uses an investment beta to help predict how an investment might move relative to market fluctuations. | Most accurate for short-term investing. |

| Does not address the underlying company's strengths and weaknesses. | ||

| Risk-Free Rate | Using the U.S. Treasury bill interest rate is a stable proxy. | Choosing the appropriate risk-free rate requires estimating how long the investment will be held. |

| U.S. Treasury bill rate is only applicable for U.S. currency investments. | ||

| Market Risk | Data on overall market returns is easily attainable. | Using a broad average that represents a theoretical return on an theoretical basket of investments adds a level of impractically to the equation. |

CAPM Assumptions and Problems

CAPM is a framework for assessing the returns of an investment, correlated with the investment’s risk of underperforming. Proponents laud the way this complex goal is achieved with a relatively simple equation. Critics refer to a handful of flawed, underlying assumptions they say make use of CAPM problematic. Assumptions include:

- Investors are focused on wealth accumulation. CAPM assumes that investors are focused solely on maximising wealth accumulation while minimising risk. Though this may be true for a significant portion of investors, it may no longer be universally true, given the increasing trend of impact investing(opens in a new tab), such as environmental, social and governance (ESG) investing, which prioritises supporting socially conscious organisations.

- The market is frictionless. CAPM ignores the impact of transaction costs and taxes, which are real considerations for many investors. It also largely ignores inflation.

- Equally informed investors. CAPM presumes that all investors have equal, simultaneous access to information. In practise, this is not always the case, as some investors could be privy to key pieces of information(opens in a new tab) in advance of others.

- A stable risk-free rate. The risk-free rate selected for use in CAPM should align with the investment timeline. Unfortunately, this presupposes that the risk-free rate will remain constant for the duration of the investment, which may or may not be the case. However, changes in the risk-free rate can put pressure on returns from riskier investments — a point investors should factor into their decision-making.

- No unsystematic risk. CAPM focuses on the systematic risk of the markets and ignores unsystematic risk. It assumes that investors can, or already did, diversify their portfolios of holdings to eliminate unsystematic risk.

What Does CAPM Mean to Investors?

When used in conjunction with other financial tools, CAPM can be a helpful way for investors(opens in a new tab) to evaluate the risk/return dynamic for a particular investment. It’s an objective measure in an industry famous for hunches and gut decision-making. CAPM impartially measures the expected return an investor should receive as risk increases or declines. Higher relative returns calculated by CAPM indicate possible buying opportunities for investors.

Download Our Free CAPM Template

Use our handy template to calculate CAPM(opens in a new tab). With a few simple inputs, the expected return rate will automatically be generated. Spaces for descriptions and sources help document assumptions to facilitate any updates in the future.

NetSuite Gives You All the Data Needed

Optimising capital is a challenge for all businesses, but it’s especially critical for growing businesses looking to earn passive returns. Determining the required rate of return for projects and selecting the investments that are the best balance of risk and reward can be difficult without the right data. Using a planning tool, such as NetSuite’s NetSuite Financial Management software, can provide real-time visibility into available capital so companies can make better informed decisions.

Financial professionals and investors use the CAPM formula to evaluate the trade-off between an investment’s risk and its return. The calculation is an objective way to determine whether an investment is attractive, based on the investor’s appetite for risk. It is also a relatively simple method, which makes it easy to apply, but it includes some intrinsic flaws. Most often applied to investing in securities, CAPM can also be used to evaluate other investment opportunities, such as making equity investments in other companies.

#1 Expense

Management Software

CAPM FAQs

Is CAPM the required rate of return?

The required rate of return is sometimes referred to as an investor’s hurdle rate, which is a minimum rate of return that must be met for an investment. CAPM is a version of the required rate of return that factors in systematic risk of an investment.

How is return calculated in CAPM?

The CAPM formula uses the risk-free rate, investment beta and market return to determine the expected rate of return for an investment. Since the values of each variable in the equation are subject to change over time, it’s important to periodically update the CAPM. The formula for CAPM is:

Expected return = Interest rate on risk-free securities x [investment beta x (market return - interest rate on risk-free securities)]

What is the relationship between risk and return as per CAPM?

CAPM is used to weigh the potential returns of an investment against its potential risk. CAPM focuses on incremental systematic risk above certain “risk-free” levels. Specifically, CAPM uses the opportunity cost of a low-risk or risk-free investment as a type of hurdle. An investor focused only on accumulating wealth would pass on an investment if its returns were less than the CAPM. If the returns are greater than the CAPM would indicate, that same investor would take up the investment.

How would you define the capital asset pricing model?

CAPM tries to determine whether the expected returns of an investment are desirable, given the risks involved. Its formulaic approach calls for financial expertise and includes several assumptions about future returns, as well as judgements about the unique risks of the investment and common risks of the market.

What are the components of the capital asset pricing model?

The pieces of the CAPM formula are the risk-free rate (Rrf), investment beta (βa) and the market return (Rm – Rrf). The value of each piece is dynamic, so the CAPM calculation needs to be updated over time. The formula is represented symbolically as: Ra = Rrf + [βa * (Rm – Rrf)], with Ra being the expected return.

What is the CAPM model and its assumptions?

CAPM is a method for evaluating an investment’s returns compared with its risk. Some of the embedded assumptions include that investors are focused only on accumulating wealth, that the market is frictionless, that all investors are equally informed, that the risk-free rate aligns with the investment timeline and that there’s no unsystematic risk.

What is CAPM and WACC?

The capital asset pricing model (CAPM) is a formulaic approach that calculates whether the expected returns of an investment are desirable, given the risks involved in the investment. The weighted average cost of capital (WACC) is a calculated metric that represents the average costs of an organisation’s sources of capital. These sources, including debt, common stock and preferred stock, are weighted in proportion to the overall capital makeup. WACC uses the weighting to create a blended cost, using debt interest rates, yields on preferred stock, dividend payments on common shares, as well as taxes. CAPM is used to determine a firm’s cost of equity, which is part of WACC. In turn, WACC is used for modelling discounted future cash flows when valuing a business.

Kristina Russo

Kristina Russo