Nonprofit organisations seek funding through a variety of channels; donations from philanthropic individuals and organisations and fundraising events quickly come to mind. Another way nonprofits can obtain financial support for their initiatives is by receiving grants. But that’s easier said than done. The application process can be lengthy, plus grantors typically impose requirements involving financial tracking and reporting, project plans and expected outcomes. This guide details the steps involved in the grant management process — from the grantee’s perspective — along with a primer on best practices and potential pitfalls.

What Is Grant Management?

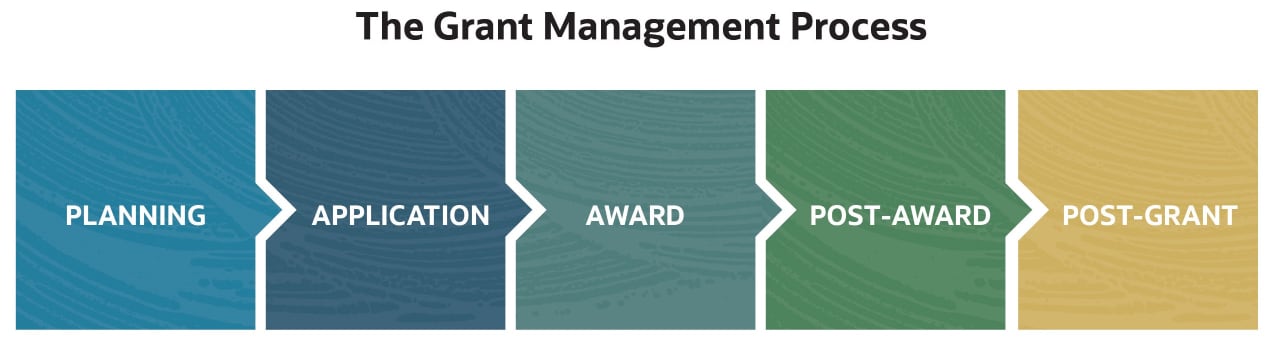

Grant management refers to the oversight of all phases of the grant life cycle, from a nonprofit finding a suitable grant and completing a proposal to receiving an award, carrying out its specific requirements, reporting results and closing out the grant process. Suffice it to say, effective grant management necessitates clear communication both within the nonprofit (the grantee) and externally with the granting agency (the grantor or funder).

Key Takeaways

- Grant management is the process of overseeing and completing the pre-award, award and post-grant phases of the nonprofit grant cycle.

- Grant management involves researching opportunities, generating proposals, tracking project milestones and recording the financial transactions that support the detailed reporting required by grant makers.

- Following grant management best practices helps nonprofits avoid common mistakes during the grant cycle.

Grant Management Explained

Nonprofits seek out grants as a means to fund their missions. Grant sources include foundations, corporations and government agencies, many of which have their own missions that support causes they believe in. For example, the American Library Association (ALA) offers a long list of grants libraries can apply for, including a series of $10,000 grants announced in July, aimed at academic libraries serving significant populations of minority students, libraries that were hit hard by the pandemic. These grants are meant to be used toward operations and to rebuild services, such as the acquisition of new materials, creation of virtual services or technology upgrades.

The process of researching, applying for, obtaining, budgeting for, implementing, reporting progress and end results to the grantor — be it the ALA or any other — is what grant management is all about. Every phase involves multiple steps and a plethora of documentation for both grantor and grantee purposes. Scrupulous monitoring and transparency are key, not only for the nonprofit to avoid possible penalties or loss of funding, but also to foster strong relationships with grantors that could lead to additional funding.

Importance of Grant Management

Grants are one type of financial support that nonprofits rely on, to varying degrees, to fund and accomplish their goals. (Other forms of support include charitable donations, volunteer staff and provisions, and sales from nonprofit-sponsored gift shops and programs.) A major metropolitan opera, for example, might rely on several small grants for its student programs, whereas a local trails group will more likely depend on a state transportation grant. But no matter the amount of the grant awarded or the size of the nonprofit on the receiving end, grant management is key to the successful execution of a grant.

Grant management begins the moment the nonprofit decides to pursue a grant. Steps include writing the grant proposal, communicating with the granting agency throughout the grant’s execution and meticulous financial recordkeeping. The latter not only helps with a funder’s reporting requirements, but it also helps the nonprofit stay in compliance with the grant’s guidelines. Failure to do so could delay project reimbursements or jeopardise future funding opportunities.

Understanding the Grant Management Process

The grant management process follows a fairly standard path. As with the pursuit of any type of funding, a nonprofit must first determine its overall objectives. Here is a closer look at what grant management encompasses.

Planning

The first step for any nonprofit applying for a grant is to assess three essential factors: its needs, what it can reasonably achieve and whether the potential funding can help it realise its vision. For example, a grant might be used to fund the hiring of a coordinator to bring the nonprofit closer to its goal of reaching a specific population. On the other hand, applying for a grant to build a new headquarters might be a stretch for an all-volunteer nonprofit with limited matching funds. In addition, each grant will require separate management, which means enough resources must be in place for oversight.

Part of planning is also figuring out which grants to apply for. Not every grant is right for every nonprofit. Some grants are given unconditionally — up front and all at once — to be used for the purposes outlined. Other grants are reimbursable, meaning that the nonprofit fronts the money for its initiative but is compensated for that outlay either in stages or in one lump sum at the end. Finally, grants can also be conditional, requiring a nonprofit to raise a certain amount of money before the grant is awarded.

The reality is, applying for a grant takes a lot of work — sometimes more work than the nonprofit can muster. So before getting started, the nonprofit needs to evaluate its true ability to execute the requirements of a grant if it’s awarded.

Application

Once a nonprofit chooses a grant (or grants) to pursue, the task of writing the proposal begins. This step can take weeks or even months. The application process involves gathering supporting documents from key stakeholders, including financials; crafting a detailed plan of work; and outlining a budget. Some grants use dedicated application portals to register applicants, such as Grants.gov, which administers federal grants. Other groups, like the San Diego Futures Foundation(opens in a new tab), provide online applications on their websites.

Grant applicants should read through the application carefully, noting the grant’s requirements and application timelines. Application narratives should be specific to the grant at hand and articulate how the grant will be used to benefit the community.

Though the exact details requested by each grant-making organisation differ, certain components typically recur: Funders will want to know something about the nonprofit, how the proposal’s objectives will be achieved with the funds, and how success will be measured and communicated back to the funder.

Award

If chosen for the grant, the nonprofit will receive formal notification and a grant agreement from the grantor laying out the grant’s funding amount, project timeline, reporting requirements and other terms and conditions. Once both parties sign the agreement, the grant is officially in effect and, at least in the case of an unconditional grant, funds can be dispersed. In some instances, the nonprofit can try to negotiate aspects of the grant before signing it — perhaps something changed after the nonprofit submitted its application that will affect timing of the project’s milestones, or more clarity is needed about payment terms. Whatever the circumstances may be, industry experts advise nonprofits approaching negotiations to lead with gratitude and transparency.

Post-Award

With the grant in hand, the nonprofit is ready to begin its work. It will need to keep detailed records about the project’s progress and provide periodic reports to the grantor, per guidelines of the agreement. Every line item of the budget and all data points on how funds are spent — backed by supporting documentation, such as time sheets and invoices — must be accounted for. Grant management software can handle the complexity of tracking and managing progress and key performance indicators (KPIs). It also keeps a system of record for the nonprofit to refer to for future projects. According to research from Insight Partners, the market for grant management software will reach an estimated $2.9 billion by 2027, for reasons including nonprofits’ desire to centralise their information, monitor performance and drive efficiencies through automation.

Post-Grant

The post-grant phase of grant management, also known as the grant closeout, marks the end of the grant. The nonprofit grantee is usually expected to provide the granting agency with financial records, project outcome details, management analysis and anything else the grantor requests. For example, an affordable home-building nonprofit might have to provide members of the grant-making organisation with a tour of its work. In the case of a reimbursable grant, funders might expect a detailed report and KPIs about the grant’s impact before releasing its final payment.

The timeline for post-grant reporting can take several months, extending from the moment the grant closes to one year from its award date. Failure to provide complete and timely grant closeout reporting can reflect negatively if the nonprofit seeks future grants.

Grant Management Roles and Responsibilities

In the nonprofit world, the roles and responsibilities of grant management may fall on the shoulders of one or two volunteers in a small nonprofit or be spread among various staff members in a large charitable organisation. Every relevant role is important to the overall grant-management process.

Grant Writer

Grant-writing requires an experienced writer who can clearly and effectively pull together and organise information from various parts of the organisation. This person must be able to tell the nonprofit’s story, detail its goals and communicate how receipt of the grant will further the nonprofit’s ability to achieve its mission in ways that are meaningful, not only to the community but to the grantor as well. Some organisations may choose to outsource this responsibility to a professional grant writer, if the skills are not available in-house.

Grant Manager

From start to finish, the grant manager oversees all aspects of the nonprofit’s grant process. This encompasses working with staff, volunteers and nonprofit stakeholders, such as board members, to gather the information needed for the grant application; supervising the writing and submission of the grant proposal; ensuring that the required documentation and reporting of project milestones and outcomes are sent to the grantor when they’re due; and monitoring overall spending. As the liaison between the nonprofit and grantor, as well as with the stakeholders, the grant manager must possess excellent communication skills.

Finance Manager

The finance manager is charged with everything related to the grant’s dollars and cents. This person plays an active role in the development and negotiation of the budget, keeps spending in check, makes sure spending complies with the grant’s guidelines and is responsible for keeping financial records up to date — both for internal assessment and for outbound reporting. Nonprofits must meet unique financial reporting requirements, so the finance manager ensures that the grant is being used as specifically intended.

Program Manager

The program manager works with the grants team to identify programs or initiatives that need funding and to develop programs that align with specific grant opportunities. Once a program is funded, the program manager is responsible for the project’s implementation and, in collaboration with the grant manager, ensures that the grant’s requirements are all satisfied.

Compliance Officer

While smaller nonprofits may not have a dedicated compliance officer at their disposal, it is important that someone make sure grant spending complies with all applicable rules and regulations during all phases of the grant cycle. Federal grants requirements can be especially complex. The compliance officer’s responsibilities also include proper disclosure of grants in all nonprofit tax and board filings, as well as maintaining records needed for reporting purposes.

Preparing for Grant Management Before Proposal

Grant writing can take anywhere from 10 hours to upwards of 100 hours to complete, depending on the size of the grant and level of details required. And that doesn’t include the time a nonprofit will need to engage with stakeholders, collect necessary supporting information or complete any of the following pre-proposal conditions before embarking on what will likely be a sizable effort.

Identify Potential Funders

Grants can be found through myriad databases, backed by a great deal of research to determine which sources best align with the nonprofit’s specific mission, values and needs. For example, is the funding to be used for a new program or to help defray overhead costs? For a federal grant, a nonprofit must first register with Grants.gov. Grants from foundations and other nonprofits can be gleaned via Candid, which offers information about grant opportunities from a broad field of philanthropists, especially those that don’t have websites of their own, or other sources dedicated to connecting grant seekers to grant makers. Board members and community leaders with a passion for a nonprofit’s mission are also important resources to engage about funding. Perhaps a local bank has a community foundation looking for a project to fund in the nonprofit’s town, or a large company is hoping to channel some money to efforts that support the public good. Networking and relationship-building are key components of a proactive grants search.

Develop a Grant Strategy

Any good business plan begins with a strategy that sets forth how an organisation intends to reach its goals. A grant strategy lays out the nonprofit’s mission, what it seeks to accomplish, funding sources it plans to target and how it will measure its progress.

In developing a grant strategy, nonprofits should think through whether the opportunity cost of applying for a grant is worth the time it might be taking away from other efforts. Another consideration is how many grants to pursue. Going after one or two grants per year might make sense for a small nonprofit, whereas larger nonprofits with dedicated teams may be able to cast wider nets.

Create a Budget

Grantors will, of course, want to know how their money will be allocated across the nonprofit’s project — hence, the need for a budget. A budget also helps the nonprofit keep its spending in check. It should include salaries, wages and stipends; supplies and materials; transportation; training; and overhead costs. The nonprofit should be transparent about whether the award will be used in conjunction with other funding sources. And because some grants are paid out in instalments or are reimbursed, it is especially important for the nonprofit to stay on top of milestones and points at which deliverables are expected in order to receive its next round of funding.

Assemble a Grant Team

It takes expertise drawn from all parts of the organisation to put together a grant proposal. For nonprofits, team members might consist of volunteers, board members, program coordinators and finance leaders. The proverbial “boots on the ground” members of the team will be able to add texture to the grant application and share the story behind the cause.

Review Grant Requirements

Grant requirements vary by funder, but no doubt about it: They can be steep. A nonprofit needs to know what it’s in for, before dedicating the time and resources needed to prepare the grant proposal. Requirements typically include project timelines, financial reporting, progress reporting and closeout reporting. Some grant makers also require audited financials as part of the application process; others, such as government agencies, reserve the right to conduct an audit at any time for grants of $750,000 or more.

Grant Agreement and Contract Management

Notification of a grant award will be accompanied by a grant agreement, which is a legally binding contract that spells out the grant’s terms and conditions. By signing the agreement, the grantee accepts responsibility for meeting the grant’s requirements during the execution of the contract.

But before breaking out the bubbly to celebrate the win, a smart nonprofit will thoroughly review the agreement — and work with legal counsel, if possible — to ensure that it truly understands the fine print, given the many months that may have elapsed since applying for the grant.

Requirements for contract management typically include:

Tracking Deliverables

Most grantors will want to know if their funded projects are progressing according to schedule and end results. For example, a foundation might want to know the number of clients served as part of a particular outreach program. The grant manager is typically the one who tracks this information. A master calendar with key dates and reminders is vital, though automating this process with software can go a long way toward preventing missed deadlines and providing key stakeholders with visibility to the project’s progress at all times.

Managing and Tracking Grant Funds

Some grants permit nonprofits to spend their funds without any predefined conditions about how they’re spent. These are called unrestricted grants. Conversely, restricted grants mandate proof that funds are being used the way the grantor intended, such as for project equipment but not staff meal reimbursement. In the case of a reimbursable grant, the nonprofit must reach particular project milestones before funds are dispersed to cover costs. As a result, the nonprofit must manage and track its spending to demonstrate grant compliance.

Regardless of the grant’s stipulations, however, it’s a best practice for nonprofits to track their grant spending, for both proper management and accounting accuracy(opens in a new tab). (More on best practices soon.)

Reporting Grant Progress and Outcomes

Nonprofits are often required to communicate their progress to grantors while the grant is in use. The grant agreement will delineate reporting frequency, such as when certain milestones are reached or a specific time period has elapsed. Nonprofits can also view reporting as an opportunity to keep itself in check and to strengthen the bonds with their grantors.

Ensuring Compliance

Nonprofits must comply with the guidelines set forth in the grant agreement or risk loss of funding or repayment, penalties, fines, being audited or incurring legal action. Reputational damage and ineligibility for future grants are also possible. In addition, a nonprofit should note any federal, state, local and industry regulations that require compliance, such as environmental protection laws and the Occupational Safety and Health Act.

Revenue recognition(opens in a new tab) — an accounting principle that specifies the point at which a company has officially earned its money — is an important part of compliance that should be included in the grant agreement. For nonprofits, revenue recognition may occur when monies are received, though any funding restrictions placed by the grantor and spelt out in the agreement might tie recognition to when milestones are reached or the passage of a period of time.

If the nonprofit is facing challenges complying with a grant requirement, it should reach out to the funder in a timely and transparent manner. Grantors may be understanding, to an extent, if it means helping the project to succeed.

Communicating With Funder

Indeed, communication with the grant funder is a valuable relationship-building tool. Whether discussing proposal requirements up front or asking for clarification about documentation, nonprofits can benefit from establishing contact with the funding organisation. Once a grant has been awarded, progress reports and personal contact can solidify a connection beyond the paperwork and help the grantor feel part of the nonprofit’s mission, beyond just providing funds. Strong communication also can lay the groundwork for future funding opportunities.

As with any business initiative, a project sometimes doesn’t go as planned. Staff turnover or changes in the economic landscape, for example, can influence a grant’s planned outcome. Nonprofits should keep grantors in the loop as soon as it is practical. When met with proper communication, grantors may be more amenable to modifications, such as extending a project’s schedule.

Post-Grant Management

Did the grant sufficiently support the nonprofit’s objective? Did the project serve more people than expected? How were obstacles overcome? Once the grant ends, formal closeout begins, for which the nonprofit has a specified amount of time to submit final financial and programmatic documentation to the grantor.

Data Collection and Evaluation

At the end of the grant, funders will want to know, both quantitatively and qualitatively, that their money made a difference. In the case of a meals assistance program, for example, they will want to know how many meals were delivered and whether the number exceeded the previous year’s amount. The most reliable and accurate way to collect data is through use of grant management software that has tracked all aspects of the project from the very start. With data readily available, nonprofits can evaluate the program’s outcomes and expenses. This benefits grantors and grantees alike by helping them understand what did and didn’t work, possibly paving the way for future collaboration.

Reporting

Reporting(opens in a new tab) at the end of the grant’s life cycle details how funds were used (and whether any are leftover); provides explanations in the event of budget variances; notes whether desired goals were reached; describes lessons learnt; and includes relevant KPIs, visuals, testimonials and other meaningful methods to demonstrate success. Reporting also gives nonprofits the opportunity to lay out future plans and highlight synergies with the funding organisation, such as a shared passion for improving childhood literacy.

For unrestricted grants, a nonprofit may need to submit only a simple final closeout or outcome report. Reimbursable grants may require receipt of specific forms before final disbursements are made. Government grants could have their own sets of forms that need attention, as well.

Communication

Communicating with grant makers and key contact people in the funding organisation is critical through to the very end of the engagement. A constituent relationship management system (a CRM in its own right) that tracks interactions(opens in a new tab) with funders can be used for scheduling reminders to reach out or follow up with grantors, as well as for managing timelines. Integration with other components of the nonprofit’s business systems, such as accounting and financial management software, consolidates and centralises data for easier reporting.

Gratitude

Saying thank you never goes out of style. However, nonprofits shouldn’t wait until the end of the grant life cycle to communicate their gratitude for the grant funder’s role. Sending pictures as a project progresses, inviting the grantor to an event or to tour progress made, and sharing letters from community members who have benefited from the funded project are all ways to demonstrate the grant’s impact.

Relationship Building

Just because a grant has concluded doesn’t mean the grantor-grantee relationship has to end. Beyond the required compliance reports and financial information, sending an email with an update about the funded project’s ongoing effectiveness, sharing a social media post or inviting grantors to events are additional ways to keep the relationship going, possibly leading to future funding opportunities.

Mistakes to Avoid in Nonprofit Grant Management

Grant management is no small endeavour. Mistakes at any point in the process can drain resources, jeopardise the outcome of the project and possibly put the nonprofit at risk of losing future funding opportunities. Here are some common pitfalls.

Failure to Understand the Funder’s Priorities and Requirements

Funding organisations want to align with causes that further their own philanthropic missions. Understanding what they’re looking to achieve, how they want their funds to be used and other nonprofits they have partnered with can shed light on which grantors are best aligned with the nonprofit’s mission. Time spent on this early research will outweigh the time spent on applying for the wrong grants.

Inadequate Planning

“Plans are worthless, but planning is everything.” The words of former U.S. president Dwight D. Eisenhower apply to grant management. No matter what a nonprofit’s philanthropic intentions may be, any effort put forth to apply for an ill-suited grant will waste time and resources that could have been used elsewhere. Effective grant management starts with researching which grants are the right fit — which is good information to highlight in the grant application. It also involves the creation of a realistic timeline and budget, a schedule for how the grant will be implemented, having staff/volunteers in place, determining how and with what tools project progress and financials will be tracked, and any other terms and conditions the grantor sets forth.

Poor Communication

Failure to communicate can derail management of even the simplest projects. Grant management requires two separate avenues of communications: external, between the nonprofit and the funder; and internal, within the nonprofit. In either case, poor or confusing communication can potentially lead to misunderstandings that impact the nonprofit’s progress, delay and/or result in poor decision-making, lead to compliance issues and manifest in strained relationships.

Mismanagement of Grant Funds

Transparency and trust are implied when a grantor makes an award. That said, even nonprofits with the best of intentions can misallocate funds or not use them in the way the grant was intended. In some cases, a nonprofit may dip into monies that were designated for a specific use in order to support its needs in another way, such as for unrelated administrative costs. Mismanagement of funds could also result from commingling grant funds with other sources of revenue, poor recordkeeping, lack of financial controls or fraud.

Inadequate Reporting

The IRS requires grantors to obtain reports from grantees on their use of funds, compliance with grant terms and progress made — without which the grant will be treated as a taxable expenditure for the grantor. If reports are insufficient, missing or late, the granting organisation may withhold or call back funds from the grantee. Inadequate reporting could also mislead the nonprofit about its progress and lead to misinformed decision-making. The more manual work involved in the reporting process, the more error-prone the results are likely to be.

Failure to Comply With Regulations

Nonprofits that receive federal, state and local grants must comply with the federal government’s Uniform Grant Guidance, which has been in effect since the end of 2014. Also known as “2 CFR Part 200,” the guidance outlines requirements related to financial management, procurement, audits, performance reporting, internal controls and reimbursement of direct and indirect program costs.

Nonprofits must also report grants from any source as part of their yearly IRS Form 990 filing in order to retain their nonprofit status. Failure to file Form 990 can result in the loss of the group’s tax-exempt status. The IRS must also be provided with a list of the reports required by the grantor or an explanation of research undertaken.

Common Compliance Issues Nonprofits Face in Grant Management

Nonprofits pursue grants to fund programs and projects that will further their mission. But with the award of a grant come compliance requirements that can add complexity to the management process, especially if handled manually. Common compliance issues include:

Recordkeeping

Nonprofits must keep a wealth of detailed records for accounting and regulatory purposes and to ensure compliance with grant guidelines. That includes documentation (and proof) of financial transactions, payroll expenses, project activities and progress, procurement contracts, audit reports and communications with the grantor and within the nonprofit.

Reporting

Reporting requirements vary by grant. Grantors may mandate periodic reports on project milestones, use of funds, budget actuals(opens in a new tab), time and effort, and/or a post-grant wrap-up. One commonality among all of these varied requirements is that missing a report deadline can potentially hurt the nonprofit’s relationship with the funder. It is critical that nonprofits understand the grant’s reporting requirements and meet due dates. When it comes to grants, the more detail the better.

Budget Management

When should grant revenue be recognised? Are only allowable expenses being charged against the grant, such as supplies for a workshop? Are shared costs, such as the portion of an admin’s time spent working on the grant project, properly accounted for? Tracking and managing the budget in a fund accounting system is the most accurate way to ensure that spending complies with the grantor’s terms and conditions, especially when working with reimbursable and government grants.

Conflicts of Interest

It’s a good idea for nonprofits to have a policy in place that makes sure board members, volunteers and staff understand that information gained in the process of executing a grant cannot be used to enrich themselves or further the cause of another organisation. It is considered a best practice for all of the nonprofit’s members to sign a conflict-of-interest statement.

Ethical Standards

The National Council of Nonprofits suggests that nonprofit organisations adopt a code of ethics, code of conduct or statement of values to guide board, employee and volunteer behaviour and decision-making. “Nonprofits often engage with clients and consumers in ways that touch on confidential matters, so adopting a confidentiality policy demonstrates the nonprofit’s commitment to protect the confidentiality and maintain the trust of those it serves,” the council states. Transparency, accountability, honesty and fairness all come with the territory. Nonprofits that veer offtrack face loss of trust from the grant-making community at large and jeopardise their chances of future funding.

Programmatic Compliance

Grant spending must be used exclusively for the program-related activities presented in the grant agreement. Funders may reserve the right to request an audit of programs at any point, so up-front communication is imperative should the nonprofit face challenges, such as staffing changes or other resource constraints that affect the delivery of its plan.

Regulatory Compliance

Keeping abreast of regulations that govern a particular grant can be challenging, and even more so for nonprofits handling multiple grants. Nonprofits that receive federal grants are subject to the requirements included in the 2 CFR Part 200 guidelines, in addition to any specific agency requirements. Grants from state and local governments and any other funding sources will have their own terms and conditions, as well. Keeping detailed records of every grant-related transaction in a centralised system, separating and tracking multiple grants, and filing IRS and local tax reporting forms on time helps nonprofits stay on track.

Nonprofit Grant Management Best Practices

Grant management requires the stewardship of funds that are entrusted to the nonprofit to further their missions. Open communication, accurate recordkeeping, financial tracking and capacity planning are all critical to a successful grant outcome. Getting it right can mean the difference between a “one and done” grant or securing a steady stream of future funding opportunities. Following are seven worthy best practices.

Conduct Thorough Research

Identifying grants that are aligned with the nonprofit’s mission is a key part of grant management. Nonprofits should seek out funders that share their values and goals, with requirements they can realistically meet. Online databases, such as Foundation Directory, Grants.gov and GrantStation, are valuable resources for researching grants and finding the right fit. Assembling a list of funders with a history of giving in the nonprofit’s area can also streamline the process and improve productivity. Finally, embracing the nonprofit’s limitations is an important, time-saving exercise, in terms of discerning grants not worth pursuit.

Develop a Comprehensive Grant Management Plan

Grants can propel nonprofits into the next phase of delivering on their missions, but without a grant management plan that effectively outlines how they will meet their goals and fulfil their grant requirements, chances of success are shaky. The grant management plan should also define a grant management infrastructure that brings people and data together to satisfy a grantor’s expectations.

Establish Clear Communication Channels

From phone calls, email and collaboration tools to videoconferences and in-person meetings, communication needs to flow among all nonprofit team members throughout all phases of the grant cycle. Nonprofit staff and volunteers should meet regularly for internal updates about the project’s status. It’s also a best practice to capture meeting notes and make them easily accessible.

Communicating with the funder is also critical, in all the same ways as within the nonprofit. Grant makers want to hear how the project is coming along and will appreciate efforts made to build a transparent relationship. In most cases, grantors want to be a source of information and input as much as they want to provide financial support.

Maintain Accurate Records

Maintaining up-to-date, accurate (and, using software, real-time) records — for accounting and per the grant agreement’s requirements — should come as no surprise as a best practice. Records may need to be pulled quickly for an audit by the funder or to satisfy interim reporting requirements dictated by grant guidelines. Further, recordkeeping can benefit nonprofits to help guide grant strategy and improve efficiency as nonprofits apply for and execute future grants.

Monitor Grant Funds Regularly

Tracking grant expenditures is an indispensable best practice that’s best achieved by setting up a fund account for the grant and using software to monitor the money. Software can also flag potential problems in real time, such as expenses that exceed the budget or are not in alignment per terms of the grant agreement. In the case of shared expenses, such as a nonprofit team member working across multiple projects, funds must also be tracked to make sure they are properly allocated. Regularly monitoring time sheets and expense receipts helps nonprofits avoid errors that could drain valuable resources and sidestep potentially uncomfortable conversations with the funding organisation.

Evaluate the Project’s Impact

Once a grant-funded project is complete, a thorough and thoughtful evaluation can yield insights that benefit both the grantor and the grantee. Reporting on how the funded project unfolded, challenges encountered, lessons learnt and the program’s impact on its target audience will show funders that their monies were well spent and, perhaps, encourage continued funding. Furthermore, the evaluation gives the nonprofit the opportunity to reflect on its performance and what it might do similarly or differently in the future. For example, was the budget sufficient to cover all costs? Were goals realistic in the given time frame? Capturing qualitative and quantitative data about the grant’s impact can yield valuable insights, and perhaps new best practices, for the organisation.

Build Relationships With Funders

The success of any business contract relies as much on trusted relationships among all parties as on the ultimate aim of the contract. Building strong relationships with grant funders helps nonprofits create a pipeline of opportunities to support its goals. Ongoing communication is key, keeping funders apprised of project progress, milestones reached and amount of the grant spent. Inviting them to see how the project is coming along can also fortify relationships. The idea is to make sure grantors know that their financial backing is making a difference for the project at hand and, hopefully, for those to come in the future.

10 Grant Management Key Terms and Concepts

Every process has its own lingo, and the same is true for grant management. Among the key terms and concepts a nonprofit should understand are:

- Request for proposal (RFP): A formal document issued by a grant-making organisation to announce the availability of grants and invite proposals.

- Grant proposal: Also known as an application, a grant proposal includes the nonprofit’s history, a summary of its project, objectives to be achieved through the grant, the project’s budget, evaluation criteria and the nonprofit’s financial details.

- Grant agreement: The legal contract between the grantor and the grantee. Details include the terms under which a grant will be carried out, expected use of funds, and reporting and compliance requirements.

- Grant management: Encompasses all of the steps involved in researching, applying for, receiving, executing and closing a grant.

- Budget: Itemises the proposed costs and expenditures for executing a project.

- Deliverables: Project outcomes specified by the grant guidelines, including progress reports and interim and/or end-of-grant reporting requirements.

- Compliance: Adherence to the grant’s regulations, terms and conditions as set forth by the grant maker and government.

- Financial management: The allocation and tracking of grant monies according to the grant’s guidelines.

- Reporting: The aggregation and communication of a funded project’s progress, including KPIs, spending and key milestones, as required by the grant’s guidelines.

- Impact assessment: A detailed evaluation of the grant-funded project’s outcomes, including quantitative and qualitative data.

Manage the Grant Process From Research to Reporting in NetSuite

From application to award to closeout, an integrated cloud software solution specifically designed to address the unique needs of nonprofits can help keep tight rein on the many important aspects of grant management. NetSuite for Nonprofits manages data collection, reporting and detailed financial tracking for multiple grants so that all stakeholders — grant recipients and grant makers — are on the same page. NetSuite Customer Relationship Management (CRM) also helps nonprofits provide an engaging experience for their funders, through managing interactions and providing a seamless flow of information throughout the entire grant management process. The many efficiencies gained means nonprofits can devote their resources to executing the good work the grant supports, rather than on manual, time-consuming tasks that impede progress and may even jeopardise funding.

Grants are an important part of a nonprofit’s overall funding plan, yet their management can be complex and resource-intensive. With a comprehensive grant management strategy in place, nonprofits can navigate through the grant life cycle successfully, no matter how many requirements their grant agreement may entail, while setting the stage for future funding opportunities.

#1 CRM

In The Cloud

Grant Management FAQs

What is the meaning of grant management?

Grant management is the process of administering grants through all aspects of the grant life cycle. Preparing documentation, tracking financials, managing compliance and reporting outcomes to the grantor are all essential elements of the grant management process.

What are grant management skills?

Grant management requires strong organisational and communication skills. Grant leaders must have the ability to work both internally with their nonprofit counterparts and externally with funders to further the nonprofit’s mission.

What are the key stages in a grant management cycle?

The stages in the grant management cycle are:

- Pre-award: The nonprofit researches grant opportunities that are aligned with its mission, identifies which ones to apply for, assembles a team and submits a proposal.

- Award: An agreement from the grantor stating its terms and conditions is signed (or possibly negotiated) and the nonprofit gets to work.

- Post-grant: The nonprofit completes the project and reports results.

What are the key components of grant management?

The key components of grant management for a nonprofit include identifying grants the align with its project’s mission; submitting a grant proposal that outlines the project goals, budget details and intended outcomes; winning and signing a grant agreement; executing the project, while capturing details and communicating progress to the grantor; and closeout reporting, which summarises project outcomes, successes and lessons learnt.

What are some tips for effective grant reporting and documentation?

Effective grant reporting starts with understanding the grantor’s reporting requirements, such as what information it needs, how often it expects updates and the report format it prefers. Another tip is for a nonprofit to employ software to track progress, financials, correspondence and other relevant details. Nonprofits should be transparent about grant outcomes, including any challenges encountered along the way.

How can technology and software tools help streamline the grant management process for nonprofits?

Technology and software tools take the place of manual, error-prone processes, enabling the grant team to have more time to focus on achieving the grant’s mission. In addition, software can automatically capture real-time data to demonstrate the funded project’s progress and spending.

What are some emerging trends in grant management for nonprofits?

Emerging trends in grant management include the use of technology to submit and manage applications. Granting agencies are increasingly requiring that all documentation be submitted online, and, as volunteers and nonprofit staff continue to operate from virtual settings, having a cloud-based solution is critical. Nonprofits are also looking for grants that will support operational growth vs. traditional program delivery.