As businesses expand their operations, pursue international business opportunities and rely more heavily on data and technology, the role of the financial controller is changing as well. Regarded as a company’s lead accountant and charged with the oversight of day-to-day financial operations, many financial controllers are now also involved in strategic planning and decision-making. They’re expected to know about accounting and finance reporting systems, have a solid background in data analysis, and possess strong leadership skills, business acumen and communication skills.

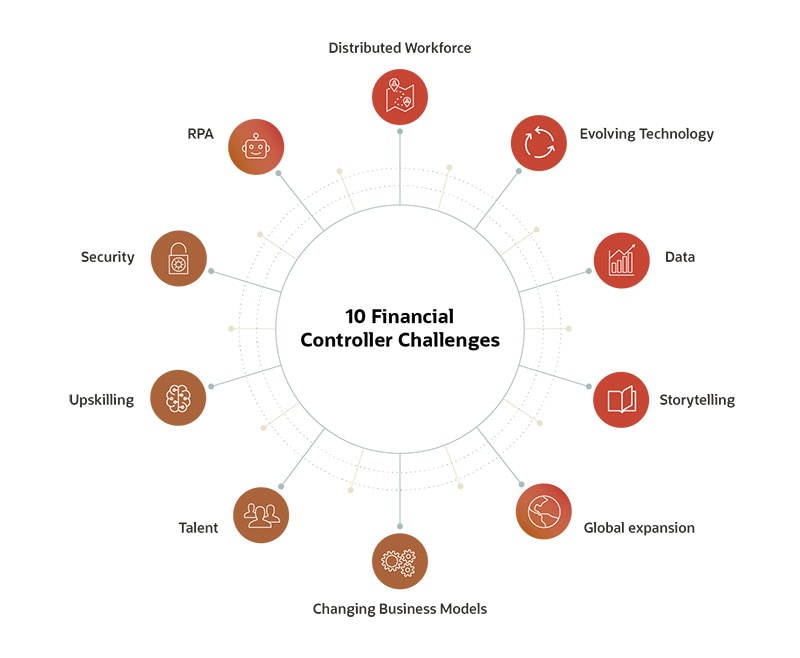

Such changes don’t come without challenges. But those challenges aren’t insurmountable. Here’s a look at 10 of the most pressing challenges financial controllers are facing and what they can do to overcome them.

What Is a Financial Controller?

A financial controller is a senior-level manager who is responsible for all of a company’s accounting and day-to-day financial activities. While the scope of responsibilities varies from one company to the next and may fluctuate based on the size of the company, a financial controller’s typical duties include:

- Preparing operating budgets.

- Managing budgeting schedules.

- Overseeing financial reporting.

- Collecting, analysing and consolidating financial data.

- Performing payroll duties.

- Reporting material budgeting variances or expenditure variances to management.

- Recruiting, selecting and training staff.

Financial controllers typically report to the company’s chief financial officer (CFO), though smaller organisations — where employees often wear many hats — may combine the two roles into a more strategic position than the one that exists at their larger counterparts.

10 Financial Controller Challenges & Their Solutions

Financial controllers are facing a variety of new challenges as businesses continue to evolve. Today, they must be stewards of data and technology, prioritise new skills and assume leadership roles to drive the finance and accounting function forward. Among the items on their priority lists:

-

A distributed workforce. Organisations contend that working remotely works, with 83% of employers saying the shift to remote work has been successful at their companies, according to PwC. Despite the many positives — increases in employee productivity fostered by advanced technologies, among them — a distributed accounting workforce can hinder financial controllers in terms of team building, communication and mentoring less experienced staff. All can lead to the perfect storm of errors that can be time-consuming and tedious to fix.

A centralised business system, such as an enterprise resource planning (ERP) solution, used by all employees can help financial controllers manage their distributed workforce better and ensure the accuracy of everyone’s work. Many ERP systems include workflow tools to monitor bottlenecks, eliminate data silos and provide insights into a team’s workload and productivity — activities that financial controllers once achieved through direct observation.

-

Evolving technology. Financial controllers today must not only be experts in the financial close, planning and reporting process, they also need to possess strong acumen in technology. In fact, according to Gartner, nearly half (45%) of IT spending will be shifting to cloud-based technologies, some of which may include finance and accounting software.

Accounting and finance are especially well suited for advanced technologies, benefiting from process automation, advanced analytics, machine learning (ML) and artificial intelligence (AI). These technologies analyse data in real time and turn data into valuable business insights — all of which can provide windows into improved business performance and savings. They also free up employees from error-prone manual tasks and let financial controllers focus more on strategic endeavours.

-

Data accessibility. Organisations are collecting data in record amounts. By 2025, the amount of data in the world is expected to reach 175 billion terabytes — a leap of 66% from 2018, according to McKinsey & Company. This exponential growth is replete with opportunities but managing it for competitive advantage can also prove challenging for financial controllers, who have a responsibility to help steer development of data governance and data strategy for the organisation, as well as apply the insights to financial planning, deploying assets, managing liquidity and more.

Some of the ways financial controllers can improve data accessibility include helping to lead data-standard alignment across departments, advocating for adopting a layered architecture that’s flexible enough for changing business needs, and deploying technology such as machine learning to clean and produce higher quality data. Integration can automatically capture financial and operational data into a cloud-based solution that becomes a single source of truth for analysis and decision making.

-

Storytelling with data. They may be the face of accounting, but financial controllers can’t rely solely on the numbers to talk for themselves. That’s why it’s critical for financial controllers to demonstrate strong interpersonal and communication skills, so they can liaise with other departments effectively and win executive buy-in.

Yet, more than just communicating effectively, financial controllers must be able to distill financial reports and other new or difficult concepts and ideas into accessible language for clients, investors, board members, management and their own teams. Telling a story is even more impactful: A recent survey of 500 decision-makers found 71% said data storytelling skills — the “why” behind the data — are very important when reporting results to the C-suite or other key stakeholders. About half (49%), however, said their organisations lack this critical skill.

Financial controllers must be comfortable with data and data analysis and use it to support the story they want to tell. Data dashboards and other financial tools can help develop a narrative that makes a message more memorable, while fostering stronger business relationships.

-

Global expansion. Ecommerce capabilities and other new technologies make it much less complicated for organisations to expand their products and services to a global audience. In fact, the proportion of tech firms with a presence in five or more markets is set to increase radically from 29% in 2020 to 70% by 2025.

Growing internationally, however, presents a number of challenges for financial controllers. For example, they will need to know how to manage the tax and regulatory compliance requirements of the various countries with which the organisation does business. Other considerations include multicurrency conversion capabilities, global financial reporting tools, and freight, insurance and customs oversight.

Having the right software in place is critical for organisations that go global. Financial controllers who use solutions that include multiple currencies, taxation rules and reporting requirements across geographies and provide real-time financial consolidation and visibility will be well positioned to help their companies.

-

Changing business models. Beginning in 2020, nearly all organisations — 96%, according to McKinsey — were forced to revise their business models to adapt to the rapidly evolving business environment and new mandates. The results appear lasting, with companies changing the way they monetise services and trending toward subscription-based services, ecommerce and bundled products and services — all of which require more complex accounting. Again, flexible technology solutions that adjust to financial controllers’ needs can go a long way in remaining competitive. Cloud-based systems often support rapid deployments, along with the ability to customise and scale, without heavy lifting.

-

Talent retention and development. Employee retention weighs heavily on finance and accounting managers, with eight out of 10 expressing it as a top concern, according to a 2022 salary guide. Low morale and high rates of burnout are contributing factors.

To boost morale and reduce burnout, financial controllers should work with their human resources department to make sure employee retention strategies are in place and in use for their teams. Some of these strategies include reviewing and streamlining the onboarding and orientation processes, obtaining feedback through engagement surveys, providing mentorship opportunities and offering training to upskill employees.

-

Upskilling. While it’s important to provide training and learning opportunities to finance and accounting teams to solidify retention, it’s equally important that financial controllers invest in their own careers by staying on top of the latest trends and brushing up on the newest skills.

While most of the financial controller’s traditional skill set will remain relevant, the addition of new, more strategic skills is also expected. Examples include development of an affinity for digital tools and technology, expertise in data analytics and competence in controlling agile teams. More than one-third of CFOs, for example, believe that business analytics skills should be mandatory for everyone in accounting and finance, according to the 2022 salary guide. Financial controllers should also seek out training, e-learning and certification opportunities to tackle acquiring these competencies.

-

Security. Concern about data and privacy breaches was the barrier most frequently cited by finance executives for failing to realise their full potential as drivers of strategic change, according to an Accenture report. The report also found that only 28% of finance professionals are engaged in managing risk through data security.

In many organisations, chief technology officers (CTOs) report to the CFO, leaving finance executives, including the controller, in a good position to have an impact on —and even lead — security efforts. One way to mitigate security risks is to advocate for a cloud-based technology strategy, which provides a number of security benefits. These include improved regulatory compliance, more frequent applications patching and end-to-end security for remote workers.

-

Robotic process automation (RPA). Sometimes referred to as “smart automation” or “intelligent automation,” RPA refers to a growing area of advanced software systems that program “bots” to perform a series of tasks that previously required human intervention. As of 2020, finance professionals said 60% of their traditional finance tasks were automated, up from 34% in 2018, per Accenture.

Financial controllers are well positioned to play an important role in an RPA program, which has the potential to reshape finance and accounting processes. The same skills that organisations have long relied on for investment valuation, project management, process documentation, and assessing, defining and implementing controls are also critical to an RPA program.

For organisations just beginning their RPA journey, financial controllers can encourage leadership and IT to gauge whether there’s an opportunity to explore the technology. They can also request quotes from RPA vendors, learn about pilot opportunities and earn RPA certificates to deepen their expertise in the area.

Today, financial controllers are being challenged by a variety of factors — rapidly evolving technology, new business models, increasing amounts of data, changing skill sets and more. Skilled financial controllers armed with top-tier financial management software and data, however, will be well positioned as strategic business leaders capable of driving finance and accounting teams into the future.

#1 Cloud

Accounting

Software

Controller Challenges FAQs

What kinds of problems do financial controllers find?

Financial controllers may encounter a variety of problems, such as financial reporting issues, budget deviations, losses due to theft or mismanagement of risk, unbalanced budgets, errors due to improper techniques, and incorrect data.

What are the challenges of financial management?

Financial management faces myriad challenges. They include accurate record-keeping, managing spend-down, timely financial reporting, financial analysis and regulatory compliance.

What are the challenges of financial accounting?

Suffice it to say, financial accounting is not for the faint of heart. Financial accounting challenges include improving cash flow, managing financial disclosures, hiring and retaining talent, adopting automation and artificial intelligence, upskilling, learning about tax law changes and understanding expense management.

Is a financial controller a stressful job?

A financial controller is a senior-level manager who is responsible for all of a company’s accounting and day-to-day financial activities. That’s a tall order. A high volume of work, tight deadlines, compliance demands, team oversight and impeccable accuracy can make a financial controller’s job stressful.