Setting detailed goals then regularly measuring progress is the best way to keep all departments aligned with the company’s long-term objectives. For accounts payable, goals can range from capturing benefits, such as early or preferred payment discounts, to cutting costs by eliminating late fees and managing cash flow by delaying payment until an invoice is actually due.

Why Should You Set Goals for Accounts Payable?

Setting goals for the AP team shifts paying bills from a mostly thankless housekeeping task to a way for that department to deliver a strategic business advantage. That’s good for both employee morale and your bottom line.

One important note: Leaders must be realistic and set goals that are reachable within the appointed timeframes. Otherwise, you’re setting the finance team up for failure. Our advice is to keep current economic conditions in mind and involve the internal experts who work on your cash flow statements and build your financial models. They will have insights into what resources AP has to work with as well as which goals are achievable and which are a stretch.

How to Set AP Goals

There’s nothing wrong with encouraging AP to aim high. When making your list of goals, remember that the ultimate aim is to eliminate money wasters like erroneous or out-of-policy expense reports, earn better terms or interest rates, capture early-payment benefits where it makes financial sense and generally improve cash flow and credit ratings.

To determine specific goals, consider best practices in cost reduction, money leveraging tactics and credit policies, as well as departmental challenges and the company’s needs in terms of cash and credit availability.

Here are tips for goal-setting success.

Review/audit your existing AP process

An important factor in meeting your AP goals: Improve or replace inefficient processes. That starts with digitising your financial records and minimising the use of paper invoices, checks and payment records. By limiting the use of paper, you reduce costs and errors while increasing access, improving data sharing among applications and eliminating the risk that physical records could be destroyed in a fire or flood. Encourage your vendors to submit invoices electronically.

Once your financial data is digital, the AP team may find that the inefficient processes used to shuffle paper invoices, receipts and other documents aren’t just clunky—they no longer work. Pro tip: Don’t simply “lift and shift” those old workflows. Review them to identify which steps or processes need to be eliminated, joined or refined to create a more modern and efficient AP department, and consider investing in optical character recognition (OCR) software to convert paper invoices to digital files. This will help greatly with a future AP automation project.

Make sure to standardise your data formats as well. For example, ensure that like fields are labelled the same way and that current exchange rates are used for currency conversion. Standardisation makes sharing or reusing data easier and more accurate.

Set SMART goals

Typically, smart technologies, often incorporating machine learning, robotic process automation and AI, are more common in the front office than departments like AP. An example of smart tech is lead management for marketing: As new leads come in, the marketing automation system can track these prospects as they move through the sales cycle.

As another example, smart credit processing automation can simplify and speed up new-customer onboarding by gathering data from the customer’s credit report, finding and validating documents without the customer having to upload them and making judgment calls on whether and how much credit to extend even if one or two of the customary documents are missing.

There are a number of ways automation can help businesses small and large. For AP specifically, automation can eliminate mundane, repetitive tasks like processing and approving vendor invoices. Payments can be scheduled automatically based on due dates, early payment discounts or other predefined rules. Regularly occurring payments to established vendors can also be approved automatically or flagged for review if amounts are above a certain threshold. Bottom line: Smart processing technologies help integrate information from various applications. CFOs can and should advocate for technology to help their teams work smarter.

Teams also need to set smart goals by determining which processes should be automated and connected to ensure fewer errors, more transparency and greater efficiency.

Goal categories: accuracy, efficiency, adaptability

While there are many goals for AP staff to aim for, accuracy, efficiency and adaptability are the top targets.

Accuracy in AP isn’t just about inputting data correctly and filing proof of payments and other documents properly, although both are critical. Ensuring accuracy also involves precision and standardisation, as well as frequent updating, in account reconciliations, mathematical calculations, supervisory checks and balances and in building audit trails to find and correct errors easily, saving time during annual audits and lowering audit fees.

There’s simply little room for error anywhere in AP processes. Set goals to steadily improve accuracy and to catch errors earlier.

Similarly, as we discussed, you won’t gain efficiency if you just automate existing antiquated processes. To make AP more efficient, rethink processes—how can you get the job done with minimal effort, time and resources? You’ll also need to tweak processes for timeliness rather than rely on batch executions. For example, your old AP process may have been to pay invoices on the 15th and 30th of each month. With automation, you can cut costs by moving more quickly on invoices that offer an early-pay discount and improve cash flow by waiting until the due date to pay invoices that do not offer similar discounts.

Set goals that will bring AP to its prime efficiency level in every process. Interestingly, a recent Brainyard survey found that finance leaders are now pushing to adapt to new challenges by adopting more technology. Make sure AP gets in on that momentum because this is the way to that greater accuracy and efficiency.

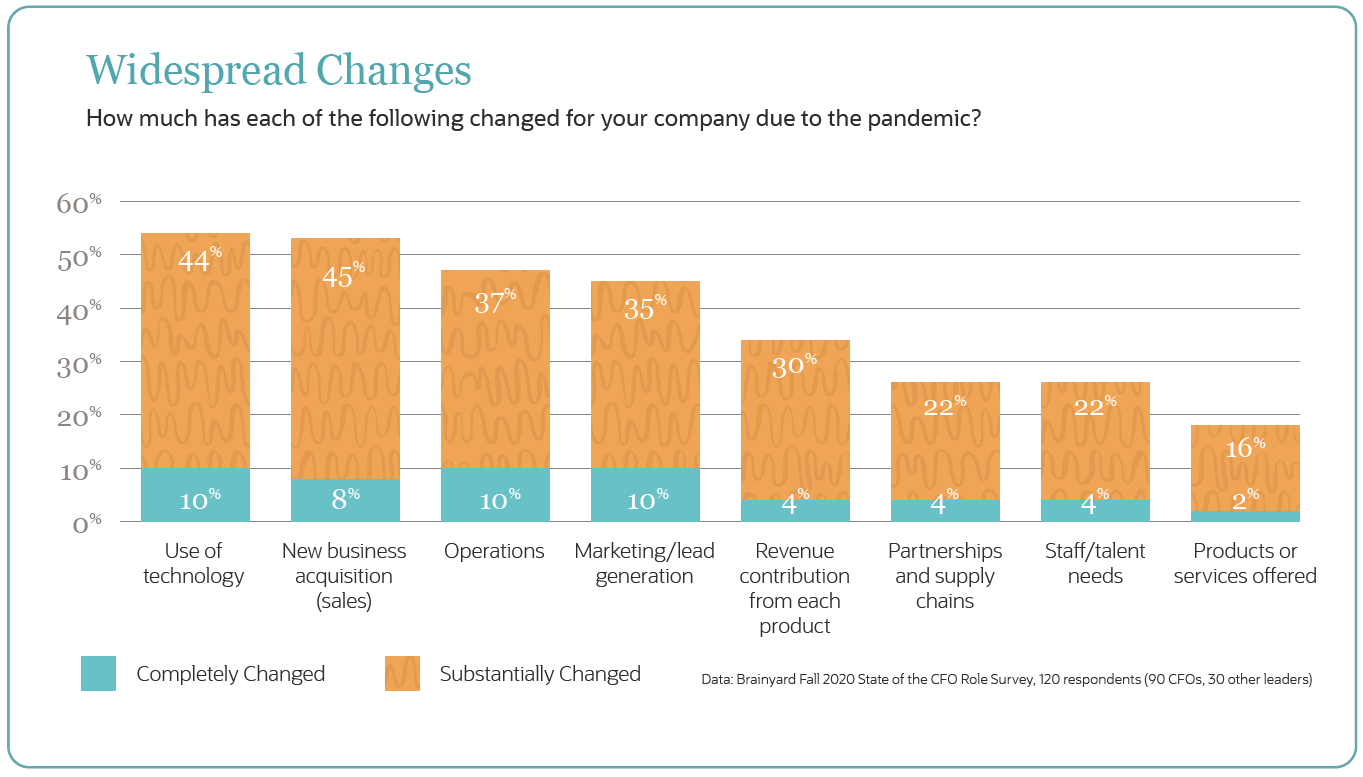

Chart 5: Widespread Changes

Deck: How much has each of the following changed for your company due to the pandemic?

Thirdly, adaptability needs to be a prime AP goal because the company will evolve over time along with customer needs and the overall economy. Overly restrictive AP processes can hobble a business’ competitiveness or harm its reputation and creditworthiness.

12 Examples of AP Goals

While AP objectives will vary according to company needs and culture, overarching business strategy and industry-standard practices, there are some goals that are common to all.

1. Saving time

A big benefit of adding efficiencies to your AP processes: Freeing staff from spending time on rote tasks so they can focus on more strategic and rewarding work.

This can be achieved in several ways, from automating repetitive tasks to using smart technologies like robotic process automation (RPA) to gather data across applications for more efficient, ad hoc integrations and shorter processing times.

2. AP employee training

AP staff know their stuff when it comes to finance tasks but can still feel a bit lost when new technologies are deployed. Make employee training and refresher courses an ongoing goal. Technology adoption rates will increase, and so will staff efficiency.

If resistance to using technology persists, it may be because those employees are concerned about losing their jobs to automation. Counter that by offering examples of new initiatives that provide more opportunities for advancement and skills development. The best way to get your AP staff on board and excited about learning is to have the HR team run a “people analytics” exercise, where HR looks at business objectives to decide where training/retraining or new talent is needed.

3. Providing employee support

It’s common for a new technology to seem simple in the training session but, in actual use, somehow become a lot more complex. Work with the vendor or your integration partner to provide, from Day 1, support to help people get past any obstacles and to learn more features as their familiarity with the software increases.

Some tried-and-true methods are appointing a peer “super user” for each department and/or providing on-demand video tutorials and FAQ documents.

4. Increased accuracy

For best results, set specific accuracy goals. Benchmarks might be reductions in data errors measured in percentages or occurrences, or in standardising fields or forms in and between processes. Choose specific areas where you want to increase data accuracy, set realistic timetables and then use metrics to measure progress.

5. Performance

Performance goals you’ll likely want to set include compliance, cost reductions, performance against budget, and gained efficiencies. Automating the entire process rather than each part separately will net you bigger gains in each of these and other metrics too.

Fiscal metrics are some of the easiest to track and, for obvious reasons, the most used in finance. Let’s look at a few of those.

6. Cost reductions

Again, set specific and granular goals. Sources for savings might include fewer staff hours spent on repetitive, low-level work; harvesting more early-pay discounts; renegotiating more favourable terms and interest rates; or better transparency for earlier course corrections.

7. Invoices paid on time

The days of paying based on an antiquated and often arbitrary policy are long gone. Modern AP departments are aiming for more strategic gains over payor convenience. Paying invoices on time affects both cash flow and company reputation. It’s just as important not to pay an invoice too early as it is to not pay late. Set goals for timeliness so that cash and early discounts are harvested but invoices that offer none are paid on the due date instead. And, watch for these six common invoicing problems that can gum up the works.

8. AP processing time and backlog

Automation is the best means to eliminate AP backlogs and achieve a higher AP turnover ratio because it speeds processing time. Set specific goals that will help you get as automated as your company can manage so that efforts are holistic rather than piecemeal.

9. Days payable outstanding

DPO is a telling ratio as it reveals how long it takes a company to pay its debt obligations. In other words, it’s an indicator of how well the company manages cash outflow to vendors and other creditors.

A higher DPO may mean the company has good liquidity and retains its money longer by paying bills later. However, if the DPO is too high, it flags likely trouble in paying bills at all. A low DPO indicates a company pays too fast, which may leave it strapped for cash at some point.

Set goals that will keep your DPO in the sweet spot—neither too high nor too low—for the sake of your company’s overall financial health.

10. Volume-based metrics (number of invoices processed)

Set goals here to determine that work is proceeding at a pace sufficient to complete the tasks at hand and pay invoices on time. By tracking the number of invoices processed, you’ll have a good measure of not just the amount of work being done but the number of vendors the company is using. Too many vendors can lead to opportunities lost in volume discounts and bargains. Too few can leave your company vulnerable to a disruption or stoppage at the vendor.

11. Payment metrics (number of payments made)

“Exceptions” are discrepancies, often on the vendor’s end, and they require handling within automated systems. Payment metrics will tell you how often exceptions are occurring and whether the problem rests with the vendor or your processes. Because exceptions are expensive to handle, you’ll want to know which vendors are clogging up your systems—or what in your processes is creating a bottleneck. This knowledge will assist you in rectifying the problem.

Tips for Managing Receivables and Payables |

|

|---|---|

| Receivables | Payables |

| Offer a discounted payment in return for quicker payments | Check contracts to be sure that your company isn’t paying suppliers early |

| Engage with consumers to help prevent late payments, disputes or defaults | Map your business-critical suppliers to determine priority of payment |

| Send timely, thorough invoices and proactive reminders | Check for discounting opportunities with suppliers |

| Ensure there are no barriers to payment, such as invoice errors or delayed billing | Communicate to understand which suppliers may be at risk and which suppliers can potentially extend terms |

| Prioritise customers with large balances in the cash collections process | Ensure systems and processes are efficient to avoid delays and errors |

| Make sure your payment system is functional and convenient. Online with multiple payment options works best | Make sure that payment is performed through the agreed payment method |

| Define weekly cash collection targets | When possible, calculate payment terms from invoice receipt date rather than from invoice date |

The goal should be a steady reduction in the number of exceptions. You may also want to set a bar on the number of monthly or quarterly exceptions deemed acceptable by your company for your AP team to strive toward.

Also note that exceptions can indicate fraud, a significant problem with AP. The AFP’s annual survey reveals ongoing increases in the prevalence of scams. Consider special recognition for AP staffers who spot and blow the whistle on fraud attempts.

12. Financial metrics (rebates earned, early pay discounts taken)

Tracking rebates, discounts and other available payment rewards will help you harvest more of them. In this case, financial metrics measure how much money was gained through these measures. This means that not only were such opportunities identified, they were also successfully completed. Set goals to ensure your AP team consistently cashes in.

AP Automation Can Help Achieve Your AP Goals

Most companies find that they outgrow their AP processes as they achieve bigger and better things. That is especially true if your AP processes are paper-based. Handling paper will slow you down, especially when there is an appreciable and growing volume, and it’s costly, too. Eventually, antiquated, paper-based AP processes will become an obstacle to growth because they negatively affect your cash flow.

AP automation software enables your team to scale to accommodate change and new growth without disruption. Further, automation can transform AP from a simple cost centre into a strategic finance differentiator. By taking advantage of newfound benefits, from early-pay discounts to contract terms management, you can move your company ahead faster.