Accounting software manages the core financial operations and data at the heart of any business, so it’s important to choose accounting software with the right features for your company. Accounting software saves time and money by automating financial tasks, like recording transactions, tracking payments and generating financial statements. Some accounting software adds features like advanced analytics, mobile support, payroll, asset tracking, budgeting and project accounting. Not all businesses need every feature — but it’s important to consider how your needs may expand as your company grows. Here are 10 key accounting software features to look for, together with an overview of the benefits of accounting software and some of the challenges it meets.

What Is Accounting Software?

Accounting software helps businesses record, manage, analyse and report their finances. It also helps businesses operate more efficiently by automating accounting tasks, such as recording transactions, creating invoices, tracking incoming and outgoing payments, creating financial statements and collecting and paying taxes. By taking advantage of accounting software, businesses can accelerate critical financial processes, such as closing the books at the end of each accounting period. Accounting software typically handles general ledger, accounts payable, accounts receivable, asset management, tax management and financial reporting, among other tasks. Advanced accounting software packages also include real-time analytics that provide an accurate, up-to-date view of the company’s financial health and help businesses make better-informed decisions.

Some accounting software products are designed primarily for small businesses with a few users, while others can support both small- to medium-sized companies and larger enterprises. Increasingly, accounting software is cloud-based. That typically means it’s easier to manage than on-premises software and easier to scale to meet growing business needs.

Key Takeaways

- Accounting software helps businesses more efficiently record, manage, analyse and report their finances.

- Core accounting features include recording and categorising transactions, managing the general ledger and the chart of accounts (COA) and generating financial statements and other financial reports.

- Other features to look for include real-time analytics, mobile support, billing and invoicing automation, budgeting and forecasting, asset tracking and project accounting.

- It’s important to consider not only the features that your business needs today, but also ones your company will need to support future growth.

- Software that’s integrated into cloud-based ERP suites makes it easier for companies to scale and add functions as their business expands and their needs become more complex.

Why Use Accounting Software?

As companies expand, manually entering and tracking financial transactions becomes overly cumbersome and time-consuming. Manual accounting also creates other challenges, from data entry errors to siloed data and difficulty complying with regulatory and tax requirements. Accounting software can help with many of those challenges. Here are some of the most common reasons for adopting accounting software:

- Automate time-consuming, error-prone manual processes. Manual data

entry is labour-intensive, especially as transaction volumes increase. It also increases

the likelihood of errors, with potentially serious consequences for the business.

Switching to accounting software offers the potential to automate and accelerate many

accounting processes, from entering transactions to creating invoices, tracking payments

and generating reports.

- Support business growth. As businesses expand, so do their accounting

needs. Cumbersome manual accounting processes can become a drag on business growth. The

company may struggle to complete vital financial tasks on time, such as invoicing

customers, collecting cash, paying bills and closing the books. Accounting software

allows companies to do more with fewer staff, helping companies manage growth while

reducing labour costs.

- Eliminate data silos. Storing financial data in a collection of

spreadsheets or paper documents means it’s harder to share information across the

company. Copying data from one tool to another is slow, labour-intensive and potentially

leads to errors. Accounting software consolidates financial data into one system, so

everyone has access to a single, accurate source of information.

- Make data-driven decisions. When financial information is scattered

across multiple spreadsheets and other tools, it’s hard for managers to get an accurate

overview of what’s happening across the business, and even harder to create

accurate budgets and forecasts. By centralising financial information and

providing reporting and analysis tools, accounting software helps companies make

better-informed decisions.

- Meet growing compliance needs. As companies expand, it can become increasingly burdensome to comply with tax requirements, regional accounting standards and other regulations. Companies with international operations must comply with the tax regimes and accounting rules in different countries, for example. Accounting software can help overcome these challenges.

Benefits of Accounting Software

Companies adopting accounting software typically realise many benefits, such as increased operating efficiency, data accuracy and visibility into financial information. Most accounting software can automate and streamline everyday bookkeeping tasks. Some products offer additional benefits that come into play as companies grow, such as global tax management and compliance with global accounting standards.

- Increased efficiency. Accounting software increases operating

efficiency by automating everyday financial tasks, such as entering transactions,

creating invoices and paying bills. For many companies, this automation is a key factor

in accounting software’s return on investment (ROI). Automating repetitive operations

frees up staff to spend

less time processing paperwork and more time focusing on problem-solving and analysis.

Some accounting software integrates with broader enterprise

resource planning (ERP) systems, so companies can use a single suite of

applications to manage their entire business. With all business data stored in a single

database, ERP systems eliminate repetitive data entry, accelerate workflows and

facilitate communication among departments.

- Scalability. The right accounting software can help companies scale to

support business growth. Cloud-based accounting software helps growing companies expand

efficiently by making it easier to add functions and users without buying expensive new

hardware or installing on-site software. Some accounting software is also designed to

support the increasingly complex needs of growing businesses, such as support for

international operations, multiple currencies and multiple subsidiaries. When management

consulting firm Prophet found that its ageing financial system created inefficiencies,

obscured visibility across international operations and couldn’t support global growth,

it switched

to cloud-based software from NetSuite to increase efficiency and visibility

across nine international offices operating in four different currencies.

- Real-time, companywide visibility and collaboration. Managers and team

members have instant visibility into financial data, such as payments, account balances

and sales. They can be confident that they’re seeing a picture of how the business is

operating at that time, not last week or last month. Customisable reports, dashboards

and other analysis tools let managers quickly assess a company’s strengths and any

problems that need to be addressed. Managers can view data from across the company,

helping them make better-informed decisions about how to implement new strategies and

adapt to market trends. For example, fast-growing digital analytics provider

Contentsquare adopted

NetSuite when it found that relying on Excel for its finances and customer

billing left the company struggling with incorrect information and bogged down in manual

processes. As a result, it has instant access to clear and accurate information from

across the company.

- Improved accuracy. Because accounting software automates data entry and

other accounting tasks, there’s much less potential for human error. Storing all

financial information in a single system eliminates error-prone copying and pasting

between different tools.

- Accelerated financial processes. Accounting systems accelerate

important financial processes that can otherwise be extremely time-consuming. They help

companies consolidate and reconcile information to quickly complete financial close

processes with less effort at the end of each period. Built-in financial reporting lets

businesses more easily generate financial statements to meet reporting deadlines.

- Added security and continuity. Accounting software uses customisable

access controls, encryption and other built-in security features to ensure that only

authorised users can access sensitive data. Some accounting systems store financial data

in

the cloud, rather than on-site, ensuring round-the-clock access to data even in

the face of power outages or natural disasters.

- Better budgeting and forecasting. Leading accounting systems include

budgeting and forecasting capabilities that use historical and current information from

across the business to more accurately predict the company’s future revenues, expenses

and profitability.

- Compliance with tax and accounting rules. Accounting software can help businesses ensure compliance with the accounting standards in each region where they operate. For example, some software can help companies automate compliance with both U.S. Generally Accepted Accounting Principles (GAAP) and the International Financial Reporting Standards (IFRS) used in other countries.

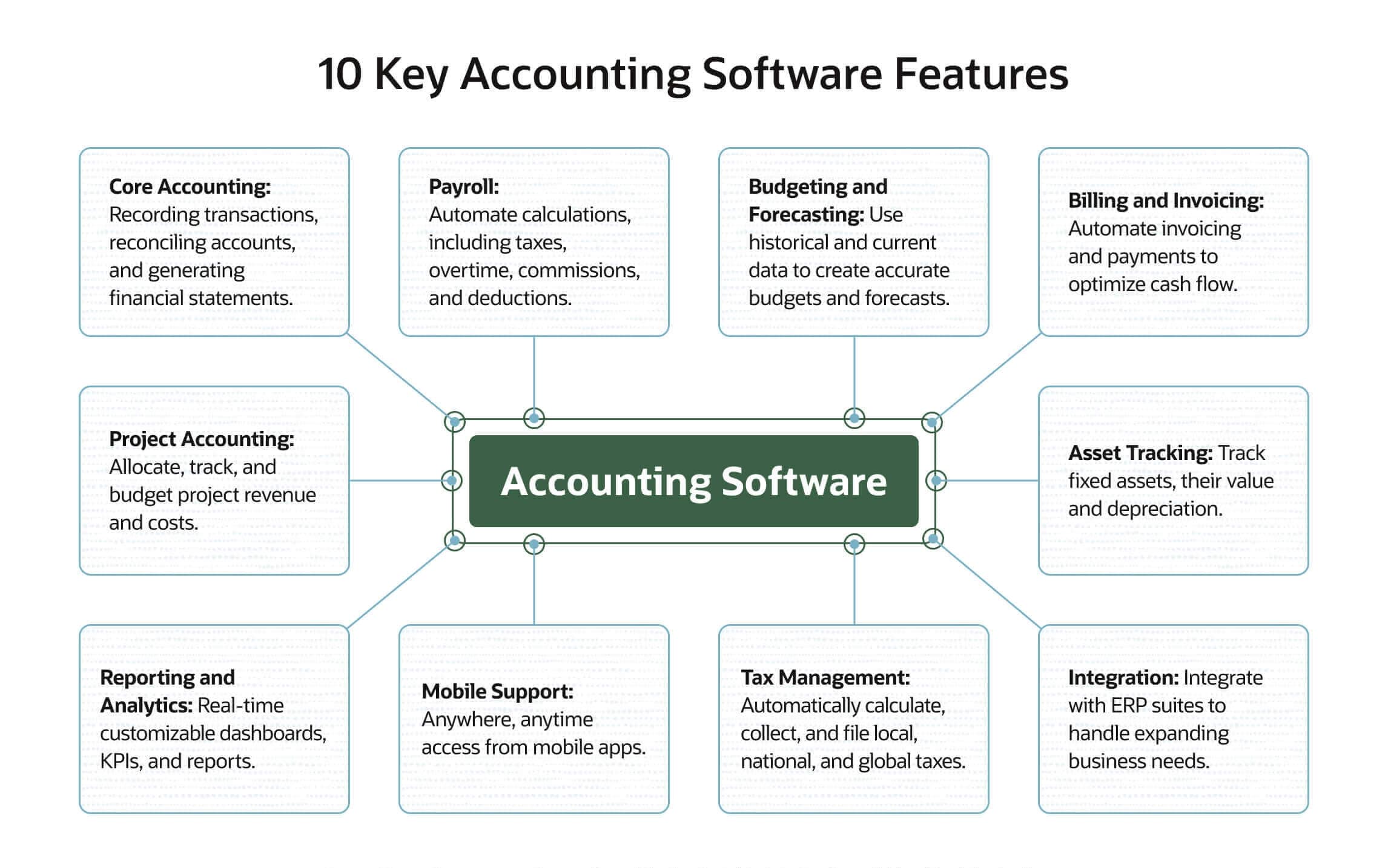

10 Key Accounting Software Features for Your Business

All accounting software should handle the core accounting tasks of recording transactions, tracking payments and generating financial statements. But most companies need additional features, especially as they grow. When choosing accounting software, it’s important to examine each feature closely, to ensure that it will meet your needs now and in the future. Here are 10 key features to consider.

- Core accounting

- Payroll

- Budgeting and forecasting

- Billing and invoicing

- Project accounting

- Asset tracking

- Reporting and analytics

- Mobile support

- Tax management

- Integration

1. Core Accounting

Accounting software should provide comprehensive support for core accounting functions, such as recording and categorising transactions, managing the general ledger and the chart of accounts (COA) and generating financial statements and other reports. These functions are essential for tracking revenue, expenses and cash flow. For example, implementing NetSuite helped MD Restaurant Group quickly generate consolidated financial reports and automate bank reconciliation for 19 business entities, including multiple fast-serve restaurants.

Accounting software should automate basic bookkeeping functions and workflows, such as creating journal entries, reconciling accounts and performing basic calculations. An important feature is the ability to comply with regional accounting standards; some software enables businesses to toggle quickly between the GAAP standard used in the U.S. and the IFRS used in other countries. This is particularly helpful for growing businesses with international operations.

2. Payroll

As companies grow, payroll quickly becomes too complicated to calculate and manage manually. That’s especially true for businesses that deal with such variables as multiple pay scales, overtime, benefits, sales commissions and contract workers. Integrated payroll management software automates payroll calculations, such as gross and net pay, payroll tax withholdings and health and retirement benefits. The software also creates mandatory W-2, 1099-MISC and other forms. Businesses can ensure that local payroll taxes in each jurisdiction are accurately collected and filed — a must-have feature for businesses operating in multiple states or countries. For example, N&N Moving Supplies found it almost impossible to manage its growing multistate business and workforce with QuickBooks and a third-party payroll provider, in part due to difficulties maintaining accurate time records and reconciling payroll with general ledger accounts. By using NetSuite to manage its accounting and payroll processes with a unified system, N&N was able to reduce processing time by 84% while improving accuracy.

Some software can automatically scan and analyse timesheets and cut cheques or directly deposit funds into employees’ bank accounts. Ideally, software should offer self-service capabilities that let employees view their paychecks and other key information online.

3. Budgeting and Forecasting

Businesses can use a combination of historical and real-time data to create budgets and forecasts that help managers project future business performance. Companies can then track actual performance against the budget to identify and address any problems. Managers and financial specialists can drill into the details to pinpoint specific areas that have exceeded the budget, quickly identify issues and make adjustments to improve business performance. Analysing the information also helps businesses create more accurate forecasts for the future.

4. Billing and Invoicing

Accounting software can accelerate cash flow by automating invoicing and collection processes. For accounts receivable, the software can automatically generate invoices, manage credit terms and improve payment collection with automated alerts and multiple payment methods. Accounts receivable staff can track the current status of all outstanding invoices, view each customer’s payment history and monitor key performance metrics, such as days sales outstanding (DSO).

For accounts payable, accounting software can automatically scan incoming bills, code expenses, automate approval workflows, schedule payments and control disbursement. That helps ensure that the company pays bills on time and captures any available vendor discounts. Automatically matching the goods received to purchase orders and vendor bills saves time, reduces errors and helps prevent fraud. When professional services company Cigniti used spreadsheets to manage billing, the process took up to 25 days. By upgrading to finance and accounting software, the company cut the process to just five days.

5. Project Accounting

Many businesses need to account for revenue and expenses on a project basis. Examples are construction firms, consulting companies and others that undertake project-based work for clients. Software can simplify many of the specialised bookkeeping tasks required for project accounting by automating the allocation and tracking of project revenue and expenses. Project accounting enables companies to monitor progress against key project milestones and invoice customers as each milestone is reached. Managers can create project budgets based on the company’s previous experience and compare actual expenses with planned budgets in real time to determine whether adjustments and course corrections are needed.

6. Asset Tracking

Many companies have significant investments in long-term assets, such as machinery, vehicles and real estate, as well as short-term assets, like inventory. Tracking the value and other details of those fixed assets over their entire useful lifespan, which can span many years, can be complicated. That’s why many companies use fixed asset management software, as well as inventory management software, to track the company’s total asset bases. Fixed asset management software automates depreciation calculations, typically with the ability to use different depreciation methods for GAAP compliance and for tax purposes as necessary. Software can also maintain a running total of the fixed assets that contribute to a company’s value and maintain records of each item’s value, inventory level, condition and cost.

7. Reporting and Analytics

Accounting software helps businesses complete financial statements, such as income statements or balance sheets more quickly and accurately than using labour-intensive manual methods. But accounting software provides additional reporting features that help managers and financial specialists monitor the company’s business performance. Leading accounting software includes customisable, role-based, real-time dashboards and analytics that enable financial teams to keep tabs on key financial metrics and drill down to explore trends and issues. Advanced analytic tools provide detailed insights into the company’s current financial health. For example, managers can analyse data to identify the most valuable customers, payment trends and patterns in expenses. Some advanced platforms use machine learning to identify trends in historical data and help businesses make smarter decisions about the future.

8. Mobile Support

Cloud-based accounting software with mobile support lets staff access the information they need whenever they need it — whether they’re on the road, in an off-site meeting or working remotely. Employees have the ability to switch between desktop and mobile devices with the assurance that they’re always working with the most current data.

Mobile apps help staff continue managing their workflow while on the go. Some apps include customisable dashboards that let employees track key metrics, tasks and reminders, as well as enter and approve transactions. An important feature in mobile apps is the ability to work offline, so employees can continue working even when they’re not connected and upload the information later.

9. Tax Management

Accounting software simplifies tax compliance by automatically performing complex tax calculations in accordance with local, national and global requirements. This gives businesses greater confidence that they’re paying and collecting the appropriate taxes wherever they conduct business and that they have detailed line-item records available when needed. Leading accounting software lets businesses use custom rules to automatically calculate local tax obligations for both domestic operations and international subsidiaries, including U.S. sales taxes, goods and service taxes (GST) and value-added tax (VAT).

When family-owned Australian company Rio Industrial Group expanded internationally, its 30-year-old applications struggled with compliance with local tax laws and other regulations. The company switched to NetSuite software, which helped automate international tax compliance and reporting — and cut the time required for the month-end close by up to 80%.

10. Integration

Integration with other applications is a valuable feature to look for, especially as the business expands and uses a broader range of business applications. Accounting software that’s integrated with an ERP suite, for example, eliminates the need to manually transfer data between applications within the suite. It helps ensure that financial data is always synchronised with information produced by other applications within the suite, such as sales and manufacturing data. It also reduces the likelihood of data-entry errors. Integration facilitates data sharing across the organisation and gives every department a more complete view of the business in real time. For example, integration with customer relationship management (CRM) systems can help businesses provide a better customer experience by providing customer-service teams with real-time data about customer payments.

How to Choose the Right Accounting Software

For any business, it’s critical to choose the right accounting software to run your core financial processes. Start by closely examining what your business needs are today and what you will likely need in the future. A system may be able to support the number of employees that you currently have — but will it be able to scale up as your business grows? Will it integrate easily into ERP suites as your company’s operations expand? Does the supplier offer essential features, such as fixed asset management, project accounting and advanced forecasting? Do your employees find the software intuitive and easy to use?

Think about how effectively the software automates your accounting tasks and whether you can customise workflows to match your needs. Consider whether the software can handle all the regional and international tax requirements for your business operations now and in the future. If you operate internationally or plan to do so in the future, it’s important to consider whether the software supports multiple international subsidiaries and both GAAP and IFRS accounting standards. If your staff needs access from anywhere other than a single central office, think about how effectively the software supports multiple locations and mobile devices. To facilitate informed decision-making, determine whether the software offers real-time data analytics and reporting that help track key performance indicators (KPIs), delve into issues and trends and plan strategy.

Get All Accounting in One Place With NetSuite

NetSuite’s cloud accounting software helps businesses simplify, automate and gain more control over core financial processes, such as recording transactions, managing accounts payable and accounts receivable, collecting taxes and closing the books. Real-time access to centralised financial data helps businesses track performance and quickly resolve issues. NetSuite’s software handles both domestic and international operations, helping businesses support regulatory and financial compliance requirements, including GAAP and IFRS. Automating routine tasks increases productivity and frees staff to focus on higher-level activities, such as investigating problems and analysing trends. Real-time, role-based dashboards and advanced analytics help managers and finance specialists track and explore the information that’s most important to them. Because NetSuite is a cloud-based system, managers and their teams can work from anywhere, anytime.

As companies grow, NetSuite’s accounting software helps manage the challenges. It seamlessly integrates with other modules of NetSuite’s enterprise resource planning (ERP) suite, including inventory management, order management, supply chain management, warehouse management, ecommerce and customer-relationship management. NetSuite Project Accounting helps project-based businesses track and plan individual projects while maintaining integration with the company’s financial systems.

All businesses need accounting software that includes basic features for recording transactions, paying bills, invoicing customers and generating financial statements. But it’s important to consider how effectively the software’s features match your company’s requirements and how well they streamline and automate operations. In addition, think about the other features that your business will need to support growth, such as real-time reporting and analytics, payroll, forecasting, asset management and mobile support.

#1 Cloud

Accounting

Software

Accounting Software Features FAQs

Why use accounting software?

Companies use accounting software for many reasons. They include increasing accuracy and efficiency, supporting business growth, obtaining real-time views into financial information, monitoring cash flow, managing invoicing and payment processes, facilitating reporting and complying with accounting standards and tax requirements.

What are the benefits of accounting software features?

Among the benefits of accounting software are automation, which helps improve efficiency and accuracy, as well as real-time visibility into financial data, enhanced security and continuity, easier financial reporting and simplified compliance with accounting standards.

What are the top features of accounting software?

The top features of accounting software include core accounting, payroll management, budgeting and forecasting, billing and invoicing, project accounting, asset tracking, financial reporting, mobile support and analytics.

What reporting options does accounting software offer?

Depending on the specific product, accounting software can generate reports upon request or automatically at the end of every financial period (weekly, monthly, quarterly, etc.). Accounting software can help businesses generate their financial statements, as well as more detailed reports that examine specific aspects of the business, such as lists of outstanding bills and invoices.

What are advanced accounting software features?

Advanced accounting software features include support for multiple currencies and international subsidiaries, advanced analytic capabilities, such as machine learning, project accounting, fixed asset management and sophisticated customisable workflow automation.